US Ports Brace for Record-Breaking Cargo

Monthly inbound cargo volumes at major U.S. container ports are expected to near record levels as retailers accelerate shipments in anticipation of a potential strike at East and Gulf Coast ports, the National Retail Federation (NRF) announced Thursday.

Jonathan Gold, NRF Vice President for Supply Chain and Customs Policy, expressed concern over the possibility of a strike at these ports due to stalled contract negotiations. He noted that many retailers have taken precautions by shipping earlier and redirecting cargo to West Coast ports.

The contract between the International Longshoremen’s Association and the United States Maritime Alliance, which covers East and Gulf Coast ports, is set to expire on September 30. With negotiations at a standstill, the ILA has threatened to strike if a new contract is not reached by the deadline. The NRF continues to urge both parties to resume negotiations. Additionally, rising freight rates have prompted importers to ship earlier.

Gold emphasized the need for a resolution before the contract expires, warning that a prolonged strike would be detrimental to retailers and the economy. He also highlighted ongoing disruption issues, such as attacks on commercial vessels in the Red Sea, which have led to increased shipping times, costs, equipment shortages, and congestion at Asian ports.

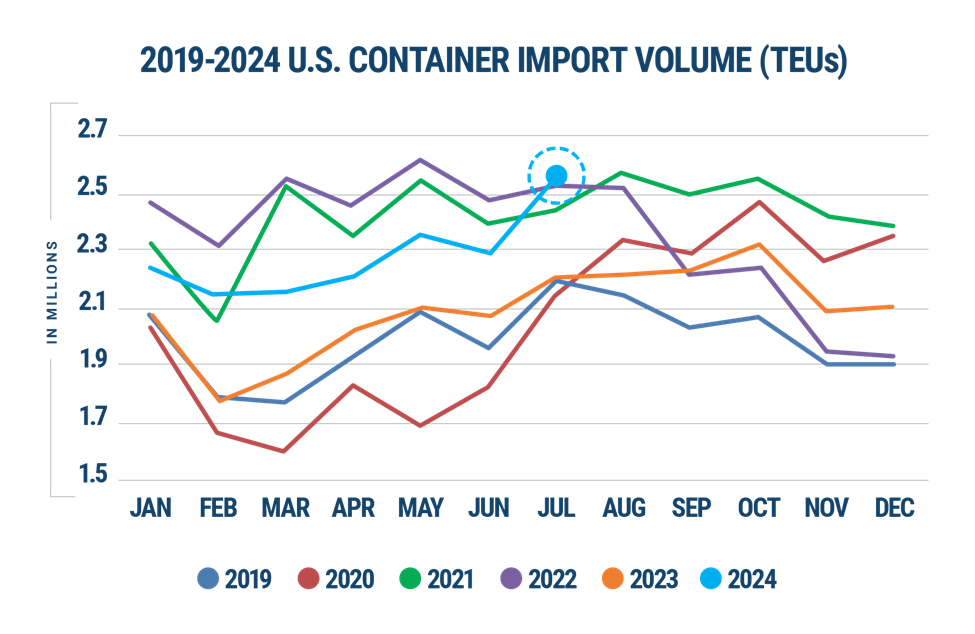

In June, U.S. ports covered in the NRF’s Global Port Tracker report, produced by Hackett Associates, handled 2.16 million TEUs, a 3.6% increase from May and a 17.7% increase year-over-year, bringing the first half of 2024 to 12.1 million TEUs, up 15% from the same period in 2023.

Ben Hackett, Founder of Hackett Associates, noted that importers are growing their inventories and shifting cargo to the West Coast as a precaution against potential labor disruptions. He stated that this shift has pushed the West Coast’s share of cargo tracked by the report above 50% for the first time in over three years.

Image Source: Descartes Datamyne.

July 2024 saw a significant surge in U.S. container import volumes, reaching 2,556,180 twenty-foot equivalent units (TEUs), an 11.2% increase from June 2024. This marks a 26-month high and the third-highest level on record, surpassed only by May 2022 and March 2022. This is also the first time in 26 months that volumes have exceeded the 2.4 million TEU threshold, a level that previously led to port congestion and delays during the pandemic years.

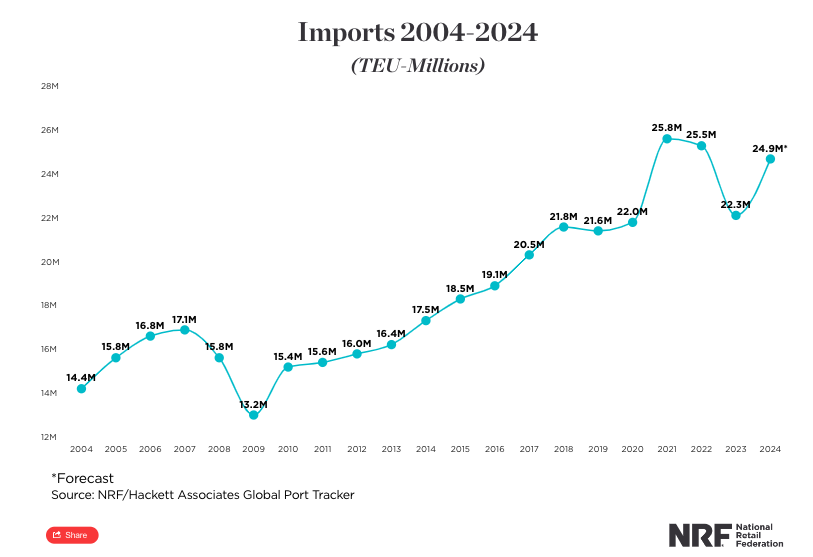

Projections for the coming months indicate continued increases in TEU volumes: 2.16 million in September (up 6.5%), 2.09 million in October (up 1.7%), 1.98 million in November (up 4.4%), and 1.94 million in December (up 3.5%). These figures would bring U.S. container imports in 2024 to 24.9 million TEUs, up 12.1% from 2023, marking the third-highest annual U.S. import volumes behind 2022 and 2021.