US East Coast Ports Are Spending Billions to Profit From Asia’s Shifting Exports

Spanning the Savannah River and named after a historical figure from Georgia's past, the Eugene Talmadge Memorial Bridge serves as a reminder of bygone segregationist policies. At a relatively youthful 33 years old, it's considered modern by American infrastructure standards. However, in the ever-evolving landscape of global trade, it has become a hindrance rather than a conduit.

To address this, state authorities are allocating $189 million to enhance the bridge, including shortening its suspension cables and elevating its deck to accommodate taller ships. These upgrades aim to facilitate access to the burgeoning docks upstream at the Port of Savannah, the nation's fourth-busiest container port.

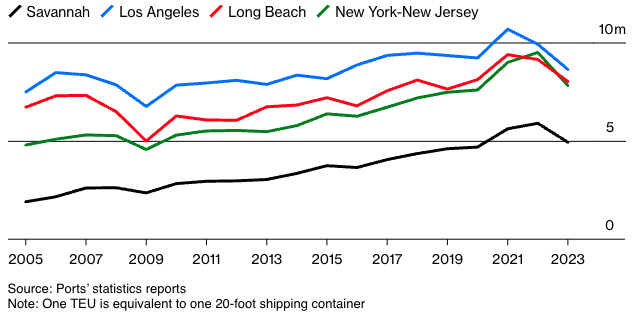

The endeavor to elevate the Talmadge Bridge is just one component of a broader initiative by the Georgia Ports Authority, which intends to invest $4.5 billion over the next decade. This investment is a direct challenge to the supremacy of the top three American container ports, primarily located on the West Coast. Despite the historical dominance of ports such as Los Angeles and Long Beach, the shifting dynamics of global trade, particularly the relocation of export production from China to South Asia, are favoring the East Coast.

Image: Largest US Container Ports, by volume of container trade, in TEUs. Source: Bloomberg

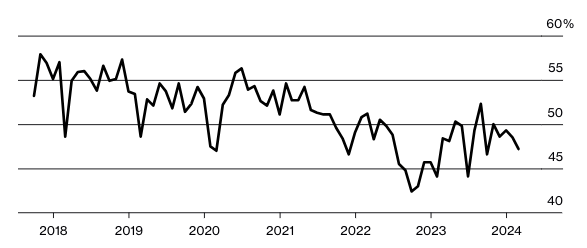

The competition between ports has persisted over decades, but emerging trends are reshaping the landscape. With more export production moving to South Asia, East Coast ports benefit from their proximity to the Suez Canal, facilitating quicker deliveries from countries like India and Sri Lanka across the Atlantic.

The Port of Savannah stands to gain substantially from these shifts, buoyed by factors such as the population migration to Sun Belt states, the burgeoning auto industry in the South, and ample real estate for expansion—a luxury lacking in congested urban port areas.

Griff Lynch, president of the Georgia Ports Authority, acknowledges the enduring influence of China but underscores the evolving market dynamics favoring the East Coast. He emphasizes the need for strategic investments to accommodate the anticipated growth in trade volume.

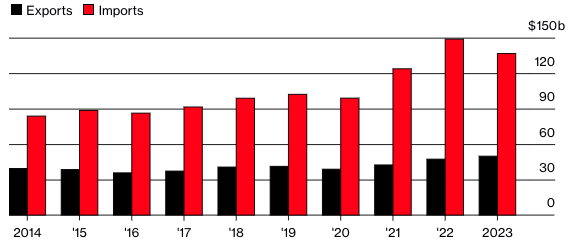

The trend towards "reglobalization," characterized by companies diversifying their supply chains away from China, presents opportunities for ports like Savannah. As evidenced by recent trade conferences focusing on India, there is a concerted effort to capitalize on emerging markets and alternative shipping routes.

Image: International Trade With Georgia. Source: US Census Bureau / Bloomberg.

The expansion plans for Savannah and Brunswick entail significant investments in infrastructure, including container terminals and new berth spaces. These developments aim to enhance capacity and efficiency to position Savannah as a leading container port in the coming decade.

Image: West Coast Ports: Share of US Inbound Container Volume. Source: The McCown Report/Blue Alpha Capital/Bloomberg.

While ports on the West Coast have traditionally held sway, their expansion capabilities are limited, unlike their counterparts on the East Coast. This limitation underscores the potential for Savannah to ascend to the pinnacle of American container ports in the near future.

As negotiations between dockworkers and port authorities loom, maintaining smooth operations will be paramount. The outcome of these talks will undoubtedly influence the competitiveness and efficiency of ports on both coasts.

In the face of evolving trade dynamics and the imperative to reduce emissions, ports across the country are navigating challenges while striving for sustainable growth. Despite the competition, the focus remains on efficient operations, environmental stewardship, and meeting the demands of a rapidly changing global market.

Source: Bloomberg