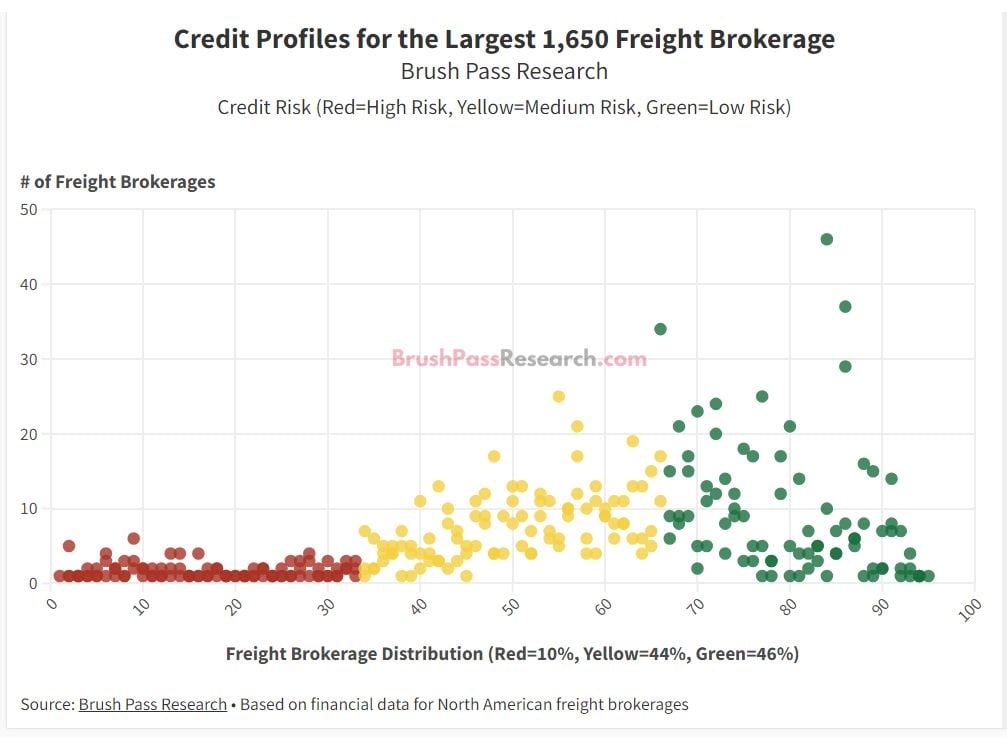

Credit Profiles For The Largest Freight Brokerages In 2024

Kevin Hill, Founder at Brush Pass Research, has provided detailed credit profiles for the largest 1,650 freight brokerages, categorized by risk levels.

Risk Categories:

- Red: High risk

- Yellow: Average risk

- Green: Low risk

Despite a challenging 27 months for freight brokerages during this market downturn, often considered a freight recession or even a depression, the overall credit scores for these brokerages are not as dire as expected.

Capacity is loose, rates are stagnant, and many brokerages have faced financial struggles during this period.

Conversely, about 46% of these brokerages are in the highest credit rating category.

Breakdown of Brokerages in the Green (Low Risk):

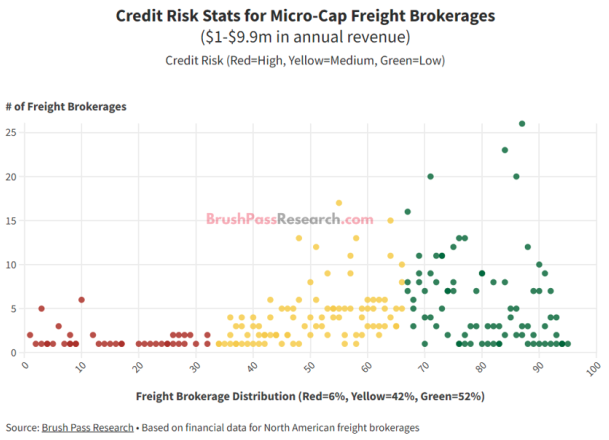

- Micro-Cap ($1-$9.9m): 52%

- Growth-Cap ($10-$49m): 46%

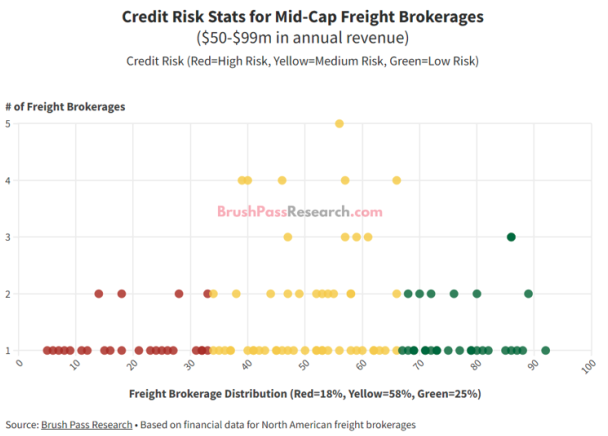

- Mid-Cap ($50-$99m): 25%

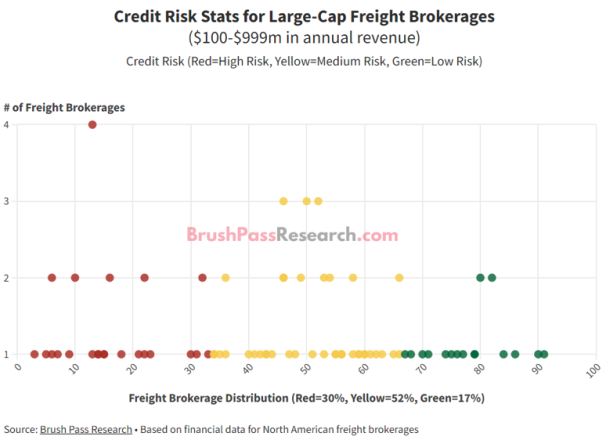

- Large-Cap (Over $100m): 17%

Surprisingly, Micro-Cap and Growth-Cap brokerages have the lowest numbers in the lowest risk category, with only 6% and 8% respectively.

In contrast, Mid-Cap and Large-Cap brokerages face greater financial challenges, such as cash flow constraints and extended payment terms, resulting in lower overall credit scores compared to their smaller peers.

Almost 30% of Large-Cap brokerages have credit scores in the lower third, while 18% of Mid-Cap brokerages are in the red.

While these lower credit scores suggest increased leverage risks and extended financial terms for customers, they do not necessarily indicate that these freight brokerages are at immediate risk of failing.