🚚 Walmart Expands Into Brokerage

Freight Friday! 🚚 We’re starting the day with news of Walmart’s new third-party logistics offering, aimed at expanding its freight services. The company has rolled out a brokerage program designed to streamline shipping and delivery for Walmart Sellers, leveraging its extensive logistics infrastructure. More ahead 👇

💬 More in Freight:

⚫️ Soliciting and Receiving Bribes for USPS Contracts

⚫️ Volatile Canadian Cross-Border Spot Market

⚫️ Arkansas Aims At Cargo Theft

⚫️ Trucking M&A Remains Hot: Gray Transportation Acquired

Soliciting and Receiving Bribes for USPS Contracts 💸

A former U.S. Postal Service (USPS) employee has pleaded guilty to fraud charges related to accepting bribes from trucking companies in exchange for awarding them contracts.

Tai Rho, who worked as a Network Specialist for USPS in Colorado, had the authority to influence trucking contracts. Court documents reveal that Rho received bribes from at least two trucking companies—one based in Texas and the other in Colorado—in return for awarding them contracts.

Rho is reported to have received nearly $300,000 in kickbacks for one contract, while on other occasions, he met with a representative of another trucking company in a parking lot to receive cash payments in exchange for a contract.

The conspiracy's purpose, as stated in court documents, was for Rho to solicit and accept bribes in return for influencing the USPS to award service contracts to specific trucking companies.

Rho was also involved in a deposition regarding a lawsuit stemming from the 2022 Weld County, Colorado crash, which killed five people and sent a driver to prison. The crash involved Caminantes Trucking, a company under contract with USPS. Although Rho has not been directly linked to the crash, he was responsible for overseeing the contract with Caminantes Trucking.

The USPS has claimed government immunity in the case. Rho entered a plea agreement in the Northern District of Texas, and the USPS has not commented on the matter, directing inquiries to the U.S. Attorney’s Office in Texas.

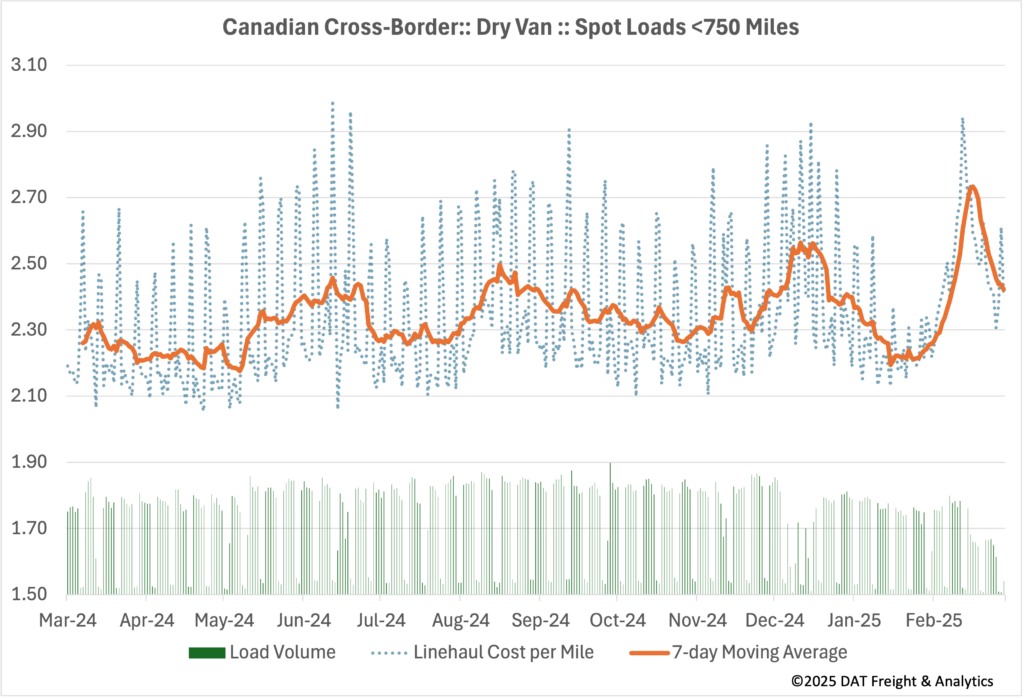

Volatile Canadian Cross-Border Spot Market 📊

February spot market data underscores the impact of potential U.S. tariffs on cross-border freight. In February, there was a notable surge in truckload volumes and rates from Canada as shippers rushed to move goods ahead of the looming tariffs.

However, as the situation became clearer, both rates and volumes began to fall below long-term averages, signaling a correction in demand.

Specifically, dry van linehaul rates from Toronto dropped by $1 per mile since March 1, now 18 cents below their seven-year averages. Ken Adamo of DAT Freight & Analytics described Canadian cross-border rates and volumes as being in "complete freefall."

Meanwhile, Canadian spot market activity saw a boost, with Loadlink Technologies reporting a 25% increase in February spot market volumes compared to January, and a 58% year-over-year rise. Both inbound and southbound loads from the U.S. experienced significant gains.

What Else is Moving 🚚

Walmart's Freight Brokerage 🚛

Walmart has recently rolled out a new third-party logistics offering aimed at expanding its freight services. This initiative, which was first announced in August, leverages Walmart’s extensive logistics infrastructure to create a new brokerage program, helping Walmart Sellers streamline their shipping and delivery processes.

The brokerage program provides trucking companies the opportunity to secure steady freight through Walmart’s network. Interested carriers are invited to join by onboarding via a dedicated website, with support and guidance available throughout the process.

To qualify for the program, carriers must meet criteria such as operating between 10 and 1,000 trucks, holding at least five years of operating authority, and maintaining liability and cargo insurance. The program is still in its early stages, but Walmart’s use of its vast logistics infrastructure gives it the potential to disrupt traditional brokerage models.

Growing 3PL Network and Amazon Competition

This expansion marks a strategic move by Walmart to position itself as a significant player in the third-party logistics (3PL) market, directly competing with Amazon’s Fulfillment by Amazon (FBA).

- Walmart’s brokerage program enables carriers to access steady freight, leveraging the company’s vast logistics network to deliver goods efficiently.

- The program positions Walmart to directly compete with Amazon’s FBA services, providing a simpler and more cost-effective alternative.

- Walmart’s expansive network of physical stores provides a competitive edge, offering quicker last-mile delivery and lower transportation costs compared to Amazon’s fulfillment model.

By using its vast network of physical stores as mini-fulfillment centers, Walmart can provide faster, more efficient last-mile delivery solutions, offering lower transportation costs. While Amazon still leads with its air fleet and global shipping capabilities, Walmart’s growing logistics network could make it a strong competitor in the North American 3PL market if it continues to scale effectively.

FREIGHT SNIPPETS ✂️

🥷 Arkansas Aims At Cargo Theft | Arkansas has passed new legislation targeting organized retail crime and cargo theft. Sponsored by Sen. Ben Gilmore and Rep. Jeremiah Moore, the bills received strong bipartisan support and were signed into law by the state's Attorney General. The law includes SB 301, which enhances penalties for cargo theft, adding up to 10 additional years in prison. It also declares a cargo theft emergency, making provisions effective immediately. The law applies to commercial shipments and defines "moving in commerce" as the entire transit journey, including temporary stops. This legislation addresses the growing issue of cargo theft, which has surged 27% from last year. Read more.

🏗️ Empty Containers Piling Up | The increase in imports to Southern California in January, driven by efforts to beat new U.S. tariffs and the Lunar New Year factory shutdowns, has led to a significant buildup of empty containers in drayage yards and marine terminals awaiting their return to Asia. The accumulation of empty containers is creating a costly logistics challenge for drayage operators in Southern California. Read more.

🔨 QXO Acquires Beacon | The acquisition of Beacon Roofing Supply by QXO, led by Brad Jacobs, marks a significant step into the building products sector, valued at $11 billion with a purchase price of $124.35 per share. The deal follows an initial offer in January of $124.25 per share. Beacon, with $9.8 billion in 2024 sales, initially rejected the offer but ultimately agreed, citing the immediate premium and certainty of cash value. Read more.

💻 Carrier Vetting Tool | Highway has launched Highway for Carriers, a tool to help motor carriers verify brokers and combat fraud. The product provides trucking companies with independently verified data to confirm broker authority, activity, and credit standing. It also identifies fraud risks like double brokering, offers access to broker contact details, and streamlines onboarding with verified brokers. Highway for Carriers aims to give trucking companies the same insights that brokers have had, helping reduce fraud in the industry. Read more.

🇲🇽 Echo's Mexico City Office | Echo Global Logistics has opened a new office in Mexico City to strengthen its cross-border solutions. This expansion follows nearly a decade of operating in Mexico, with additional offices in Monterrey, Guadalajara, and Laredo, Texas. CEO Doug Waggoner highlighted the office's role in supporting clients and carriers in the Mexican market. Troy Ryley, President of Echo Mexico, emphasized that the new office enhances local expertise, enabling the company to provide better solutions for freight moving to, from, and within Mexico. Read more.

⏸️ EU Tariff Delays | The European Union has delayed its first round of countermeasures to U.S. tariffs until mid-April. Originally set for April 1, the EU will now implement new tariffs, affecting goods like bourbon and motorcycles, worth up to 26 billion euros. The delay provides more time for discussions with the U.S. administration. The EU’s response aims to match the $28 billion economic impact of U.S. tariffs, while considering the interests of EU producers and consumers. Read more.

Pallets of News 🚛

Trucking M&A Remains Hot 🔥

Kreilkamp Trucking Inc. has acquired the assets of Gray Transportation, a Waterloo, Iowa-based company closing after over 40 years. The deal includes certain trailers, freight contracts, and some drivers, although CEO Tim Kreilkamp did not disclose further details or terms.

Kreilkamp Trucking, a family-owned carrier based in Allenton, Wisconsin, serves the Midwest and Eastern Seaboard, hauling various products. The company operates around 300 trucks and owns Brent Redmond Transportation, WB Warehousing & Logistics, Farmer’s Implement Inc., and Farmer’s Grain & Feed.

Gray Transportation, founded in 1984, had a fleet of over 150 trucks and 500 trailers, with John Deere as a major customer. President Darrin Gray cited low freight rates and rising truck lease costs as reasons for the closure, expressing hope that his drivers will transition to Kreilkamp Trucking.

OOIDA's Autonomous Concerns 🤔

The Owner-Operator Independent Drivers Association (OOIDA) expressed concerns over the risks of autonomous vehicles, criticizing the reliance on voluntary reporting for safety data. In comments submitted to the National Highway Traffic Safety Administration (NHTSA), OOIDA stressed the need for mandatory testing and transparency to ensure public safety.

OOIDA called for mandatory reporting requirements that would offer direct, accessible safety performance data, rather than relying on PR materials that don't address actual risks.

MEME OF THE DAY 😂