U.S Bank Freight Payment Index: Q4 Regional Freight Trends

The U.S. freight market showed signs of continued pressure in Q4 2024, according to the latest U.S. Bank Freight Payment Index.

The U.S. freight market showed signs of continued pressure in Q4 2024, according to the latest U.S. Bank Freight Payment Index, highlighting both cyclical and structural challenges.

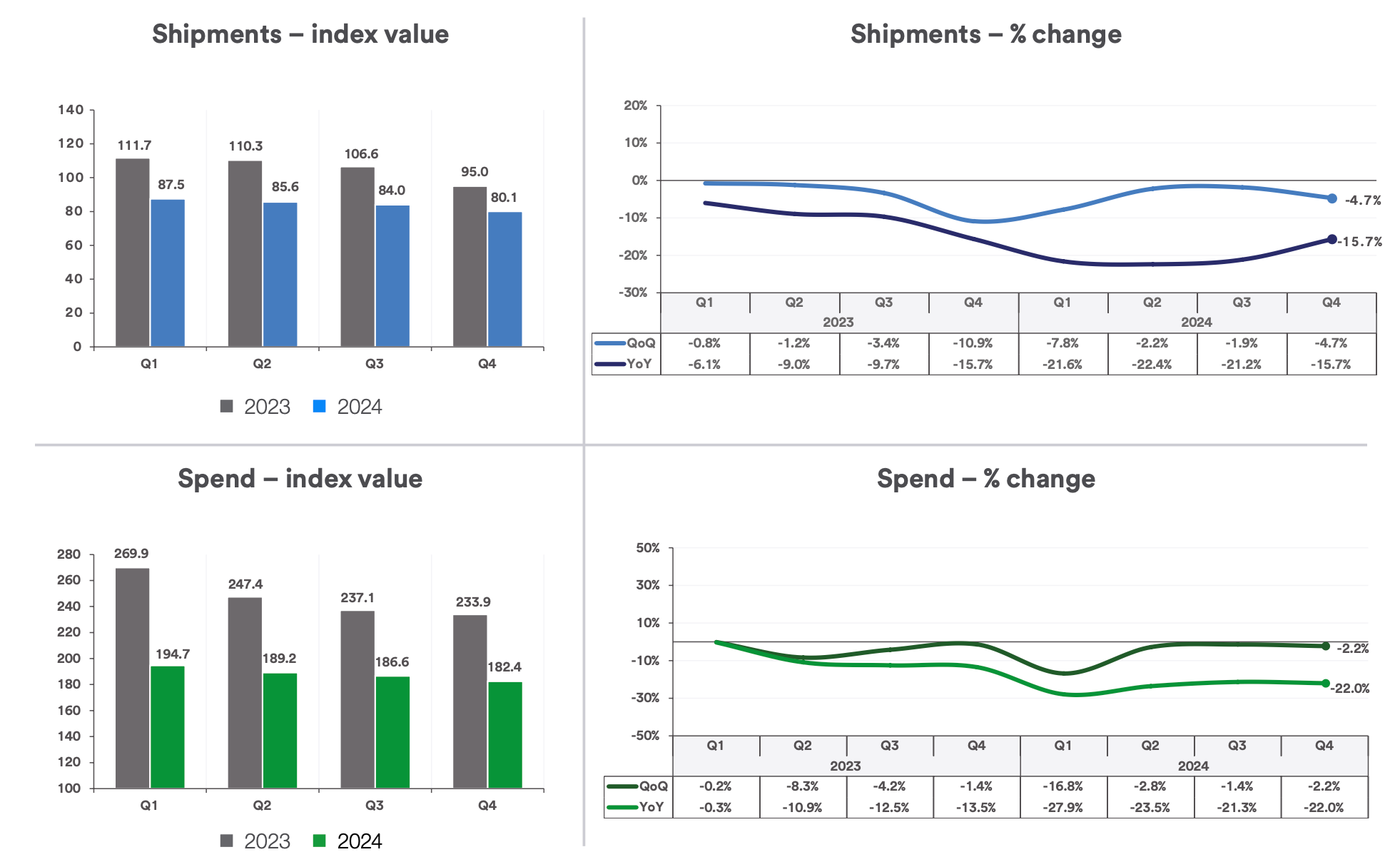

Shipment volumes fell 4.7% compared to the previous quarter, marking the 10th consecutive quarterly decline. However, spending by shippers decreased at a slower rate of 2.2%, signaling potential stabilization.

Key Data Points:

- Shipment Volumes: Decreased 4.7% from the previous quarter.

- Spending: Fell 2.2%, but the decline rate slowed.

- Spot Market Rates: Rose 0.5% from the third quarter, the first sequential gain since Q1 2022.

Signs of Stabilization: Despite the overall contraction, the fourth quarter saw the smallest year-over-year decline in shipments (15.7%) in 2024, suggesting potential stabilization. Additionally, freight rates showed mixed signals, with spot market rates rising by 0.5% from Q3, while contract rates continued their downward trajectory, down 1% from the previous quarter.

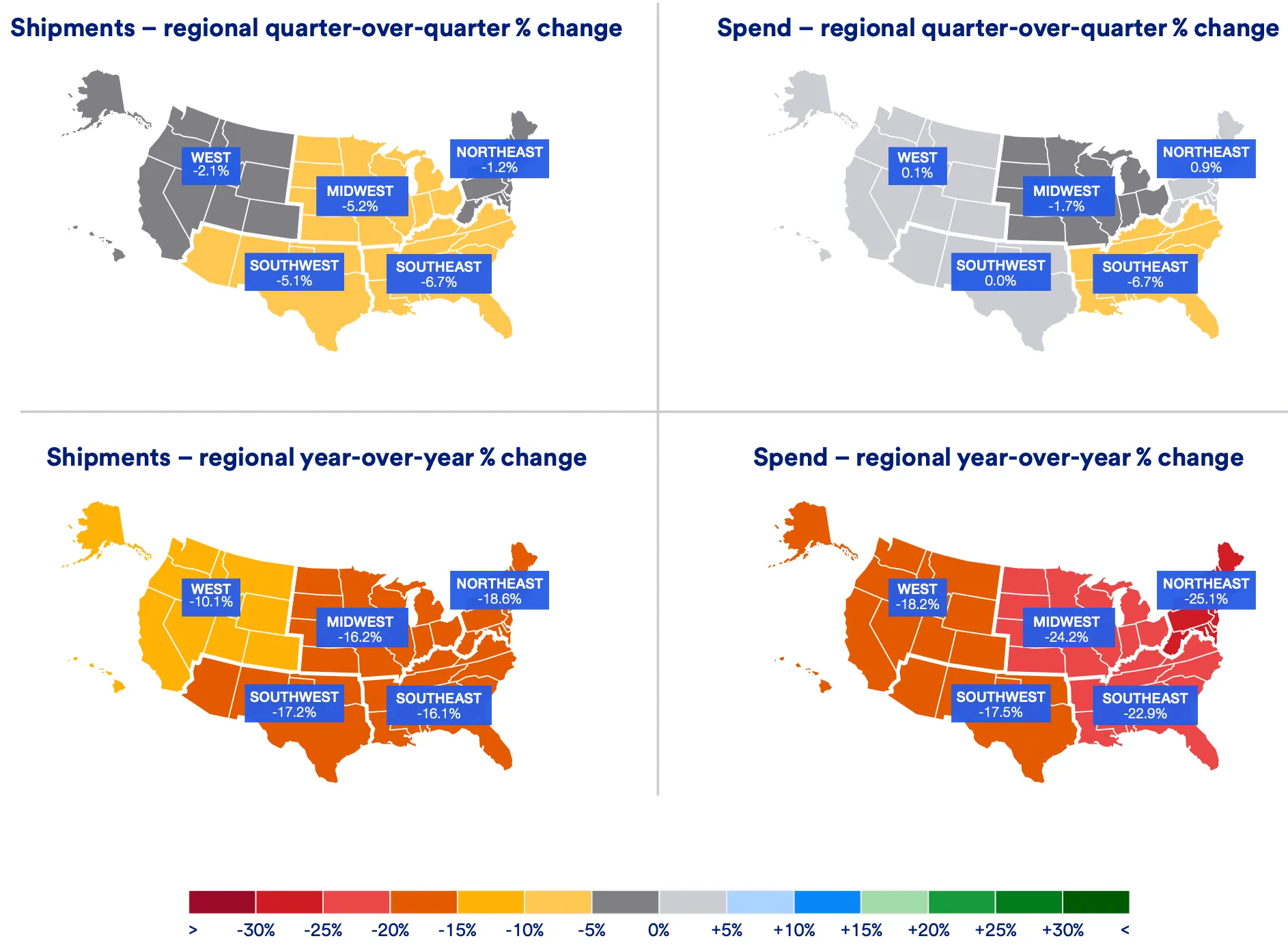

Regional Freight Market Trends: The market contraction was felt across all regions, but some areas showed resilience:

- Southeast: This region saw the largest quarterly declines in shipments and spending, down 6.7%. Severe weather events and an auto industry slowdown played significant roles.

- Southwest: Freight activity was down 5.1% in shipments, but spending remained flat, signaling potential stabilization in this region.

- West: Despite a 2.1% decline in shipments, spending slightly increased, hinting at tighter capacity, especially in ports like Los Angeles and Long Beach.

Freight Rates and the Outlook for 2025: Looking ahead, the market is likely to remain volatile, influenced by cyclical manufacturing softness and regional disruptions. However, there are early signs of a potential inflection point in 2025, driven by tighter capacity and increasing demand from sectors like retail.