🚚 Trade War Shortages?

Happy Freight Friday! 👋 The U.S.-China trade war is poised to significantly disrupt retail and trucking. Expect a slowdown in trucking activity by mid-May as dwindling imports from China lead to warehouse labor reductions. More details are coming. 👇

💬 More in Freight:

⚫️ Nuvocargo Acquires Merge Transportation

⚫️ Los Angeles Police Recover $4M In Stolen Freight

⚫️ PODCAST: All About The Broker Carrier Summit with Trey Griggs

Nuvocargo Acquires Merge Transportation 🤝

Nuvocargo has acquired Merge Transportation, its first 3PL acquisition, expanding its service offerings across North America. The deal adds intra-U.S. freight solutions to Nuvocargo’s existing U.S.-Mexico-Canada logistics services. Merge, founded in 2019, provides truckload, LTL, refrigerated, rail, and air transportation.

The acquisition adds tens of thousands of shipments annually and integrates Merge's 14 employees into Nuvocargo’s operations. Nuvocargo is also expanding its Mexico City office to improve its AI-powered NuvoOS platform for U.S.-Mexico trade.

Los Angeles Police Recover $4M In Stolen Freight 🚔

Two men were arrested in Los Angeles on charges of being involved in a criminal operation that stole, moved, and sold stolen cargo valued at over $3.9 million.

Oscar David Borrero-Manchola, 41, and Yonaiker Rafael Martinez-Ramos, 25, were taken into custody following a lengthy investigation by the Los Angeles Police Department's Cargo Theft Unit, in collaboration with other local law enforcement agencies. The arrests followed multiple search warrants at storage facilities in the San Fernando Valley.

The detectives recovered over $1.2 million worth of stolen goods, including tequila, speakers, coffee, clothing, and pet food, as well as $2.7 million in stolen bitcoin mining computers at Los Angeles International Airport (LAX) before they were shipped to Hong Kong. The cargo was found in six storage units packed with boxes of stolen merchandise.

Both suspects were booked at the Van Nuys Jail, with Borrero-Manchola released after being cited for receiving stolen property, while Martinez-Ramos was held on a no-bail warrant.

TOGETHER WITH TALENTO.

Talento is not just a nearshoring solution – it’s a partner in building and scaling a thriving logistics business. Focused entirely on freight, supply chain, and logistics, Talento offers more than just talent—it provides an entire ecosystem designed to support and optimize growth.

Beyond providing skilled, nearshore professionals, Talento helps diagnose operations, improve processes, and implement the right technology solutions.

Let Talento be the partner that helps build a dream team and scale smarter, faster, and limitless.

What Else Is Moving 🚚

Trade War Shortages Possible? ‼️

The U.S.-China trade war continues to disrupt the retail and trucking industries, with significant consequences expected in the coming months. Experts, including Molson Hart, are raising concerns over the long-term effects of the ongoing trade disruption.

Hart explains it typically takes 30 days for containers to arrive from China to U.S. ports, and an additional 45 days for shipments to reach inland hubs like Chicago and Houston. By mid-May, Hart predicts that trucking work will slow down, as warehouses face labor shortages due to the lack of goods to unload. This disruption will begin in Los Angeles and spread to Chicago and Houston, affecting the entire supply chain.

If the U.S. reverses the tariffs by May 31, it could take another 30 to 45 days for economic activity to return to pre-shutdown levels. However, even if trade resumes quickly, the recovery will be slow. Hart compares this to the economic shutdowns during the pandemic, where the supply chain struggled to bounce back. The ripple effects of empty shelves, labor cuts, and stalled shipments will likely become more evident in the coming weeks, worsening the situation for both consumers and businesses. The overall economic damage may be too severe to fully mitigate once it’s realized.

Retail Shortages and Price Hikes Loom Due to Tariff Chaos

Retailers are already seeing the impact of these disruptions, particularly in categories like apparel, footwear, toys, home goods, and electronics. These goods, which heavily rely on Chinese imports, are facing rising prices and inventory shortages due to the high tariffs imposed, including a 145% levy on some products. Many retailers, especially those focused on low-cost imports, are struggling with delayed or canceled orders, which is exacerbating the problem.

Supply chain experts predict that low-margin, fast-moving goods such as toys and basic apparel will be the first to disappear from shelves due to their reliance on lean inventories and short lead times.

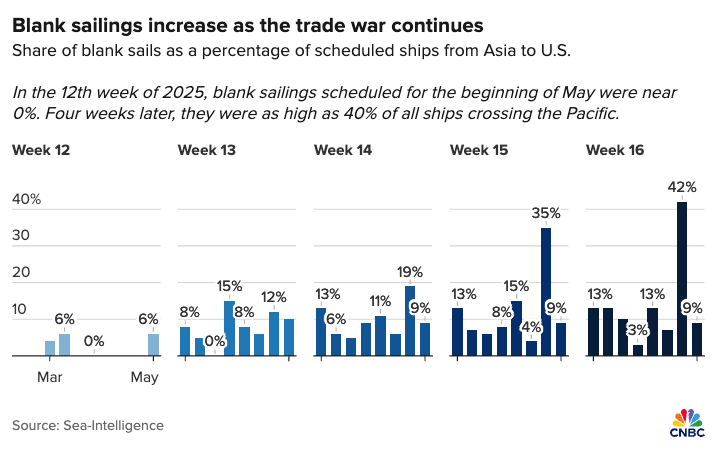

The impact is also being felt in the logistics sector, with canceled sailings from Asia to the U.S. West and East coasts adding further strain to the supply chain. While some big-box retailers have increased their orders to try to mitigate the effects, smaller businesses and dropshippers are particularly vulnerable. As the tariff situation continues to unfold, experts expect further declines in retail inventory, reduced product availability, and higher consumer prices—especially as goods subject to the higher tariffs begin to reach U.S. shores.

With the uncertainty surrounding the tariffs and trade negotiations, businesses, especially small retailers, are preparing for further disruptions. The next few months will be critical, as they face mounting challenges and rising costs, particularly with key retail periods like the winter holidays fast approaching.

FREIGHT SNIPPETS ✂️

🇨🇳 No Negotiations | President Trump announced that tariffs on Chinese goods will be "substantially" reduced but not eliminated, following weeks of retaliatory tariffs between the U.S. and China. The White House is considering cutting tariffs by 50% to 65%, according to reports. China has expressed a willingness to negotiate, but has imposed 125% duties on U.S. goods and restricted exports of rare earth materials. The U.S. recently launched a "reciprocal" tariff plan affecting most trade partners, with tariffs on auto imports and other goods. On April 24, China rejected U.S. President Donald Trump’s claim that the two sides were engaged in active negotiations over tariffs, describing any suggestion of progress as baseless, likening it to "trying to catch the wind." China’s response followed Trump’s statement on April 22, where he indicated that the tariff rate on China’s exports would decrease “substantially” from the current 145%. Read more.

🚛 $1.6B Acquisition for UPS | UPS has announced its acquisition of Andlauer Healthcare Group Inc., a Canadian provider of cold chain logistics for the healthcare sector, in an all-cash deal worth $1.6 billion. This acquisition supports UPS’s strategy to expand in healthcare logistics, a high-margin industry driven by the specialized needs of pharmaceuticals and biopharma products. The deal is expected to close in the second half of 2025, subject to shareholder and regulatory approval. Read more.

📈 CMV Liability May Raise In NV | Nevada’s Senate passed Senate Bill 180 on April 22, 2025, which would raise the state's minimum liability insurance for commercial carriers from $750,000 to $1.5 million by 2030. The bill, now heading to the Assembly, gradually increases the minimum starting at $1 million in 2026. Supporters argue it’s necessary for road safety, as Nevada’s insurance laws haven’t been updated since 1980. Read more.

⏸️ Pausing Expansion | TFI International Inc. announced it will pause all expansion and acquisition plans for 2025 due to concerns over tariffs and declining freight volumes. Despite earlier plans to move its headquarters from Canada to the U.S., the company later retracted those plans. “We had one deal we really liked, but with the uncertainty surrounding tariffs, we had to walk away from it,” said CEO Alain Bédard in an interview with Bowen Island Undercurrent. “We can’t proceed with that right now. Maybe in the future, once we have more clarity.” Bédard also noted that cargo volumes across all sectors have been “very disappointing” this year. For the first quarter of 2025, TFI saw a 40% drop in net income compared to the same period in 2024, although revenue rose 5%, driven by acquisitions made in 2024. Read more.

✂️ Mack Trucks Layoffs | Mack Trucks has announced plans to lay off 250-350 workers at its Macungie, Pennsylvania plant over the next three months. The layoffs are due to decreased demand, caused by market uncertainty and the impact of tariffs from the Trump administration. The UAW Local 677 union expressed concerns about the layoffs, with some workers still in training. The union blamed the rising truck prices due to tariffs for reduced customer orders. Read more.

👀 Truck Import Probe | The Trump administration has launched an investigation into the impact of foreign imports of medium- and heavy-duty trucks, as well as truck parts, on U.S. truck prices. The Commerce Department announced the investigation on Tuesday, focusing on the effects these imports may have on national security. The investigation also covers truck parts such as engines, transmissions, powertrains, and electrical components. The public will have 21 days to submit comments on the investigation once the notice is published in the Federal Register on Friday. Read more.

NEW PODCAST 🎧

#81: Trey Griggs, Broker Carrier Summit

In this episode I sit down with Trey Griggs to discuss the upcoming Broker Carrier Summit in Indianapolis and why it's such a crucial event for the freight industry. They dive deep into the importance of bringing brokers and carriers together to foster stronger relationships, better collaboration, and a more effective supply chain.

Trey shares insights on how the summit’s interactive sessions and community-building approach create valuable business opportunities and help address the challenges faced by both sides. Whether you're a broker, carrier, or industry professional, this conversation highlights the significance of networking and open dialogue in driving the future of freight.

🎧 Also available on Apple, Spotify, and wherever podcasts are available.

MEME OF THE DAY 😂

📍 Upcoming Events: Catch us at the Broker Carrier Summit in Indianapolis next week (April 28–May 2) and Home Delivery World in Nashville (May 21–22). Let us know if you’ll be there—we’d love to connect!