Tracking Freight Spend Across the US

The latest U.S. Bank Freight Payment Index indicates that truck freight shipments and spending continued to contract in the third quarter of 2024, albeit at a slower pace than earlier in the year.

The latest U.S. Bank Freight Payment Index indicates that truck freight shipments and spending continued to contract in the third quarter of 2024, albeit at a slower pace than earlier in the year. This mixed performance reflects ongoing pressures in the freight market, despite some signs of optimism for recovery.

National Trends and Regional Variations

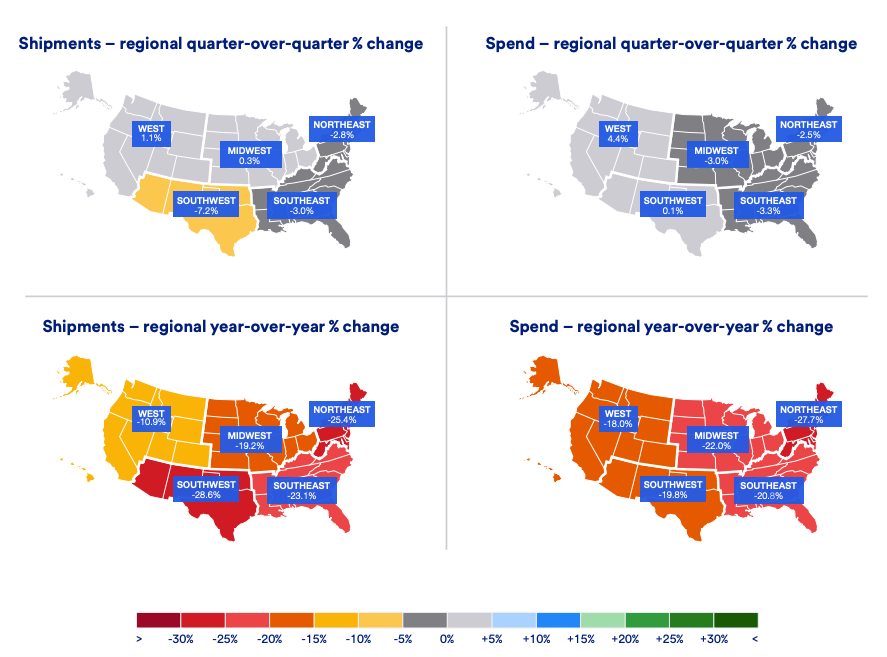

The national freight metrics for Q3 reveal a 1.9% decrease in the U.S. Bank National Shipments Index from the previous quarter, marking the ninth consecutive decline but the smallest drop in over a year. Year-over-year, shipments fell by 21.2%, one of the largest reductions on record. Despite these challenges, the slowing rate of decline suggests that the freight market may be nearing its bottom.

In terms of spending, the U.S. Bank National Spend Index contracted by 1.4% quarter-over-quarter and 21.3% year-over-year. Lower shipment volumes and decreasing diesel prices contributed to this trend, indicating that freight rates may not have eroded further during this quarter.

Regionally, freight activity showed stark differences. The West region saw a 4.4% increase in spending and a 1.1% rise in shipments, thanks to a rebound in retail imports and improved inventory replenishment efforts. Conversely, the Southeast experienced a 3.0% drop in shipments and a 3.3% decline in spending, reflecting soft consumer demand and decreased housing activity.

Regional Freight Insights

- West Region:

- Shipments: Up 1.1% from Q2, but down 10.9% year-over-year.

- Spending: Increased 4.4%, reflecting improved freight rates.

- Southwest Region:

- Shipments: Down 7.2% from Q2 and 28.6% year-over-year.

- Spending: Increased by 0.1%, the first rise since Q1 2023, indicating stable rates despite declining volumes.

- Midwest Region:

- Shipments: A modest increase of 0.3% from Q2, but down 19% year-over-year.

- Spending: Fell 3%, reflecting overall downward trends.

- Northeast Region:

- Shipments: Decreased 2.8% from Q2 and 25.4% year-over-year.

- Spending: Down 2.5%, with signs of weak freight rates.

- Southeast Region:

- Shipments: Down 3% from Q2 and 23.1% year-over-year.

- Spending: Contracted 3.3%, suggesting stable rates amid falling volumes.

While signs of recovery are present, the truck freight market continues to face significant hurdles. Industry experts suggest that any potential rebound will be gradual, as various factors—including manufacturing output and housing activity—remain sluggish.

As the freight market navigates these challenges, a more constructive framework may be emerging, particularly as the economy begins to stabilize.