🚚 Q1 Truckload Trends

Freight Friday! 🚚 We’re starting the day with a look at the RXO Q1 2025 Truckload Market Forecast. The truckload market continues to show upward movement in rates, fueled by inflationary pressures and ongoing capacity constraints.

This latest analysis from RXO dives into where both spot and contract rates are headed, offering insights into the broader economic influences and what shippers and carriers can expect in the coming months. Dive into the report 👇

💬 More in Freight:

⚫️ Cargo Thieves Attack Truck In Chicago

⚫️ Greenscreens.ai Acquired by Triumph

⚫️ Tesla Semi Rolls Through California Scale House

⚫️ PODCAST: How Does Air Freight Work with Zach Meese

Cargo Thieves Attack Truck In Chicago 🥷

Bold cargo thieves recently targeted a tractor-trailer in broad daylight in one of the nation’s top cargo theft hotspots. According to Overhaul, a shipment of consumer electronics, just departed from its origin in Chicago, was boxed in by several passenger vehicles at a railroad crossing. While the truck was stopped, the thieves cut through high-security seals and began stealing the load.

Amazon Contractors: Higher Safety Violation Rate 📈

A CBS News analysis of federal safety data revealed that contractors working in Amazon's "middle-mile" delivery network had violation rates—such as speeding and texting while driving—double those of carriers not transporting for the company. The analysis, which examined six years of Federal Motor Carrier Safety Administration (FMCSA) data, showed that carriers shipping for Amazon had average violation rates that were at least 89% higher each month compared to others.

"I was stunned," said Jason Miller, a Michigan State University professor and supply chain expert. "You don't typically see carriers nearly twice as unsafe as others in these kinds of data sets."

CBS News identified Amazon contractors using roadside inspection reports, which indicate who the carrier was shipping for at the time. The analysis focused on carriers that shipped for Amazon at least once in the two years leading up to each examined month.

Miller highlighted the challenges posed by Amazon's large, diverse network of contractors. "When you rely on hundreds, if not thousands, of smaller firms, it becomes much harder to ensure consistent safety standards, compared to working with a few large, strategic carriers," Miller explained.

What Else is Moving 🚚

Q1 2025 Truckload Market: Spot & Contract Rate Trends 📊

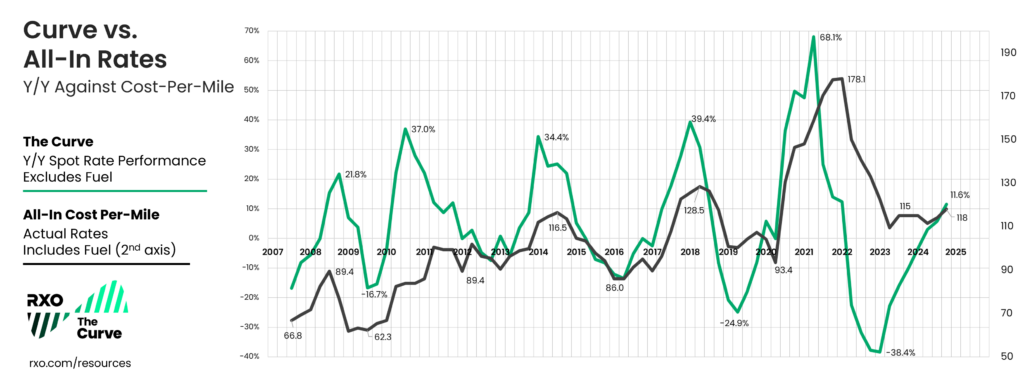

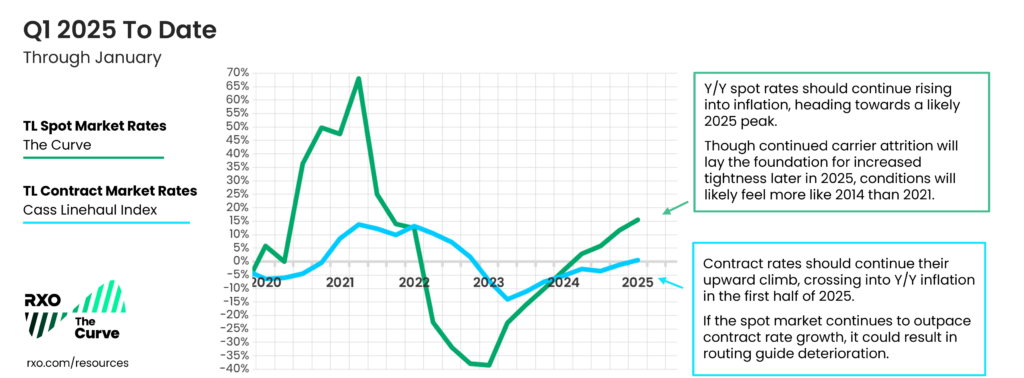

As we move through Q1 2025, the truckload market continues to show upward movement in rates, driven by inflationary pressures and ongoing capacity constraints. In this latest market analysis from RXO, we explore where both spot and contract rates are headed, the broader economic influences at play.

Market Overview

The truckload market is showing signs of continued inflation in 2025. While rates are on the rise, the market feels relatively stable with no extreme volatility yet. However, this could change as we move into the second half of 2025. For now, the key factors driving this trend are increasing operating costs for carriers and a shrinking carrier pool, both of which will continue to put pressure on rates.

Spot and Contract Rates

After over two years of discounted spot rates compared to contract rates, a shift is underway. During the holiday season, spot rates maintained a premium over contract rates, creating tension in routing guides as carriers pursued more lucrative opportunities. As the market tightens in 2025, those contract rates set during the softer 2024 market may not hold, and spot rates are expected to become more lucrative, creating further strain on contracts and leading to more volatility in the back half of the year.

Q1 2025 Outlook: A Gradual Rise

We are expecting continued inflationary pressure on truckload rates, with spot rates likely to rise faster than contract rates. This trend could lead to volatility as carriers, many of whom are cash-strapped after challenging years, look to increase profitability. Though we do not expect the extreme spikes seen in 2020-2021, rates will still continue to climb.

The State of the Industry

The broader U.S. economy is still healthy, with low unemployment and positive manufacturing indicators. However, challenges like high core inflation, trade policy uncertainty, and tariffs continue to weigh on the truckload market. The industrial sector is showing some improvement, especially in manufacturing, which could benefit freight demand in the coming months.

Key Takeaways for Q1 2025

As we progress through the first quarter, the truckload market will remain inflationary, with both spot and contract rates continuing to rise. While the operating environment will feel relatively stable, shippers should be prepared for tightening capacity, higher rates, and the potential for some volatility as the year unfolds. Staying proactive and engaged with key carriers will be crucial.

- Inflationary pressure will continue, with spot rates rising faster than contract rates.

- The U.S. economy remains healthy, but inflation, trade policies, and tariffs continue to create uncertainty.

- Operating costs for carriers remain high, making it unlikely that rates will decrease.

FREIGHT SNIPPETS ✂️

🤝 Greenscreens Acquired | Triumph Financial has announced the acquisition of Greenscreens.ai, a logistics pricing solution that uses machine learning to provide freight market pricing intelligence. The acquisition expands Triumph’s capabilities in pricing intelligence, following its recent purchase of Isometric Technologies. Triumph will acquire Greenscreens for $140 million in cash and $20 million in TFIN stock, with the deal expected to close in Q2 2025, pending regulatory approvals. Read more.

💰 Tariffs Take Effect | President Donald Trump announced that tariffs on Canada and Mexico, which have been delayed for nearly a month, will take effect on March 4, according to a post on Truth Social Thursday. Additionally, Trump confirmed that a 10% tariff on China will also be implemented on the same day. This follows a press briefing where Trump revealed plans to introduce 25% tariffs on cars and other goods from the European Union, with the policy set to be implemented on April 2. Read more.

🚧 Apple's U.S Investment | Apple is making its largest U.S. investment to date, committing over $500 billion to expand jobs, manufacturing, and research across the country. The company plans to hire 20,000 workers and build new facilities in states including Texas, Michigan, California, and Arizona. This investment aims to drive advancements in AI, chip production, and workforce training. Read more.

🔋 Tesla Semi Rolls Through Scale House | The California Highway Patrol (CHP) recently had a close look at a Tesla Semi during an inspection at a commercial vehicle enforcement facility. On February 24, the CHP’s Grapevine Commercial Vehicle Enforcement Facility shared a glimpse of the Tesla Semi as it passed through the scale house for an inspection. This isn’t the first time a Tesla Semi has been inspected at a California scale house. In 2018, a Tesla Semi passed through the Donner Pass Inspection Center, where it also received a passing inspection. Read more.

🚔 Stolen Truck Police Chase | A suspect driving a stolen semi was arrested after leading police on a multi-city chase across Southern California. The pursuit began in El Monte, with the suspect driving erratically across the 210, 60, and 10 freeways. At times, the driver swerved between lanes, evading authorities. The chase ended around 3 a.m. when the suspect crashed into the median divider on the 210 Freeway in San Bernardino. After crashing, the suspect fled on foot but was later apprehended by police. Read more.

💼 Omar Singh Starts New Company | Omar Singh is starting a new position as Co-Founder at Get Real Rates while continuing his role as President of Surge Transportation. Surge, a freight brokerage, recently emerged from bankruptcy after restructuring. At Get Real Rates, Omar co-leads a platform that enables freight brokers to tailor truckload rates based on specific needs, market conditions, and customer requirements. Read more.

NEW PODCAST 🎧

#75: Zach Meese, Airfreight Express Global

In this episode, Zach Meese, Business Development Manager at Airfreight Express Global, unpacks the dynamic world of air freight logistics—from life-or-death medical shipments to navigating complex international cargo moves.

Zach dives into the flexibility of air freight, debunking myths that it's always cost-prohibitive and showing how businesses can use tailored solutions to avoid costly delays. He shares eye-opening stories, including organizing charter flights for organ transplants and leveraging strategic air routes to optimize global supply chains.

🎧 Available now on Apple, Spotify, and wherever podcasts are available.

Pallets of News 🚛

Ocean Carriers Pricing Power Plummets 📉

With U.S. companies gearing up for negotiations, freight costs are normalizing after several months of front-loading, especially post-tariff uncertainty. AlixPartners' report shows ocean carriers on the Transpacific Eastbound lane kept their rates steady in January, signaling an erosion of pricing power.

The Drewry World Container Index dropped 10% to $2,795 per 40-foot container by mid-February. Meanwhile, MSC has suspended its new Asia-U.S. West Coast service in response to weak market conditions, with rates from Shanghai to the U.S. West Coast falling 18% in just one week.

Yellow Found Not Liable ❌

A federal bankruptcy court in Delaware ruled that Yellow Corp. is not liable for failing to provide 60 days’ notice to approximately 22,000 union employees before mass layoffs in the summer of 2023. The court determined that Yellow was acting as a "liquidating fiduciary" at the time, winding down its affairs, and not as an employer when the layoffs were implemented, which exempted the company from liability.

MEME OF THE DAY 😂