Q1 2025 Economic Freight Outlook: Motive

The outlook for cross-border trade with Mexico and the trucking market is strong as we enter 2025, driven by steady demand and ongoing supply chain shifts.

The outlook for cross-border trade with Mexico and the trucking market is strong as we enter 2025, driven by steady demand and ongoing supply chain shifts. Both sectors are poised for significant growth, with truck crossings and new carrier registrations expected to increase in Q1.

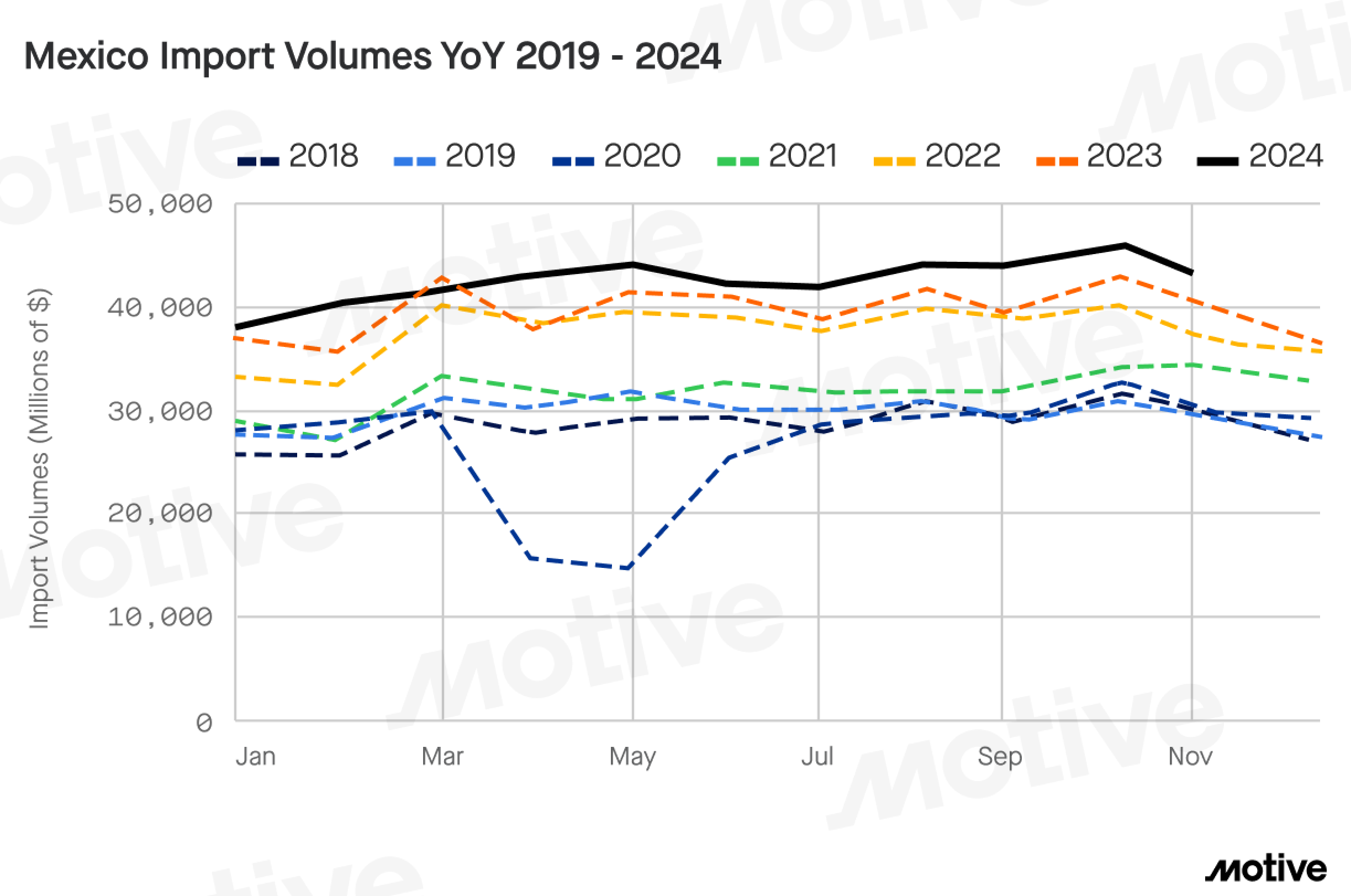

Cross-Border Trade Hits Record Highs in 2024:

Trade with Mexico saw a record year in 2024, with October marking the highest number of truck crossings ever—677,000. Laredo, the key port for U.S.-Mexico trade, saw a 28.5% year-over-year increase in Christmas imports. Meanwhile, imports from China rose by 6.7% in November, as businesses rushed to secure inventory before tariffs.

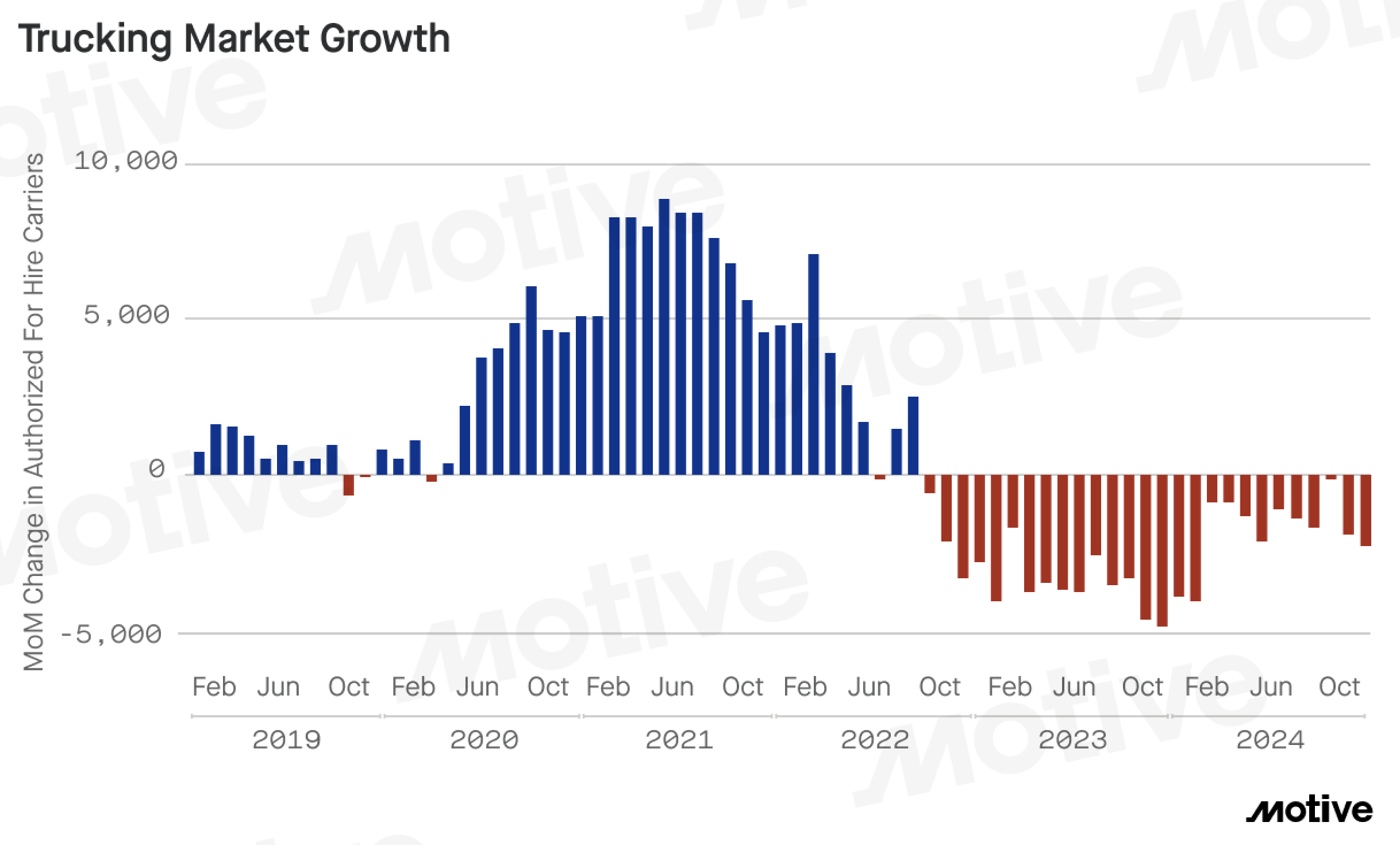

Key Data Points:

- Carrier Exits: 69% fewer carriers exited in Q4 2024 than in Q4 2023.

- New Carrier Registrations: Up 2.8% year-over-year in Q4 2024.

- Projected Growth: 28.6% increase in new registrations in January 2025.

Details on the Growth:

With freight rates stable and trade with Mexico rising, the trucking market is set for continued growth in Q1 2025. This trend is expected to be supported by demand in industrial sectors, such as oil and gas.

The outlook for Q1 2025 is positive, fueled by strong retail performance, increasing trade with Mexico, and a stable trucking market. New carrier registrations and steady demand are set to drive growth in both sectors.