🚚 Import Trends

Freight Morning! 👋 In 2024, U.S. containerized imports surged to 28.1 million TEUs, marking a 12.8% increase from 2023 and the second-highest import volume on record. However, the year also faced challenges, with supply chain disruptions and geopolitical factors shaping trade patterns. More ahead 👇

💬 More in Freight:

⚫️ Rising Demand For Hispanic Brands

⚫️ China Linked Ship Fees Move Forward

⚫️ Seeking Shareholder Approval For Nevada Corporation

⚫️ Mullen Group Acquires Cole Group

Rising Demand For Hispanic Brands 🇲🇽

With Hispanics representing 20% of the U.S. population, Source Logistics sees major opportunities in bringing Mexican food and beverage brands into the U.S. market.

The Hispanic population in the U.S. reached over 65 million in 2023, with a purchasing power of $3.78 trillion. Villarreal stated, “We understand the challenges companies face entering the U.S. and treat each customer’s needs as unique.”

Source Logistics recently expanded with new warehouses in Dallas and Laredo, Texas, and supports brands like Electrolit, which has seen strong growth in the U.S.

Looking forward, Source Logistics plans to target new markets in Atlanta, Florida, and the Mid-Atlantic and expand capacity by 20%. Supported by Palladium Equity Partners, which acquired Source Logistics in 2023, the company also acquired LaGrou Distribution’s warehousing business, adding 2 million square feet in Chicago.

With 5.6 million square feet of logistics space across 24 locations, Source Logistics now serves 75% of the U.S. population with same-day distribution, aiming to reach 95% in the future.

Cocaine Seized At U.S-Canada Border 🇨🇦

U.S. Customs and Border Protection (CBP) seized 339 pounds of cocaine from a commercial vehicle at the Ambassador Bridge port of entry in Detroit, Michigan, on Tuesday, April 15.

The vehicle, headed from the U.S. to Canada, was selected for a physical inspection. During the search, CBP officers found two duffel bags and four moving boxes containing bricks of a white powdery substance that tested positive for cocaine.

Both the drugs and the truck were seized, and the driver faces federal prosecution.

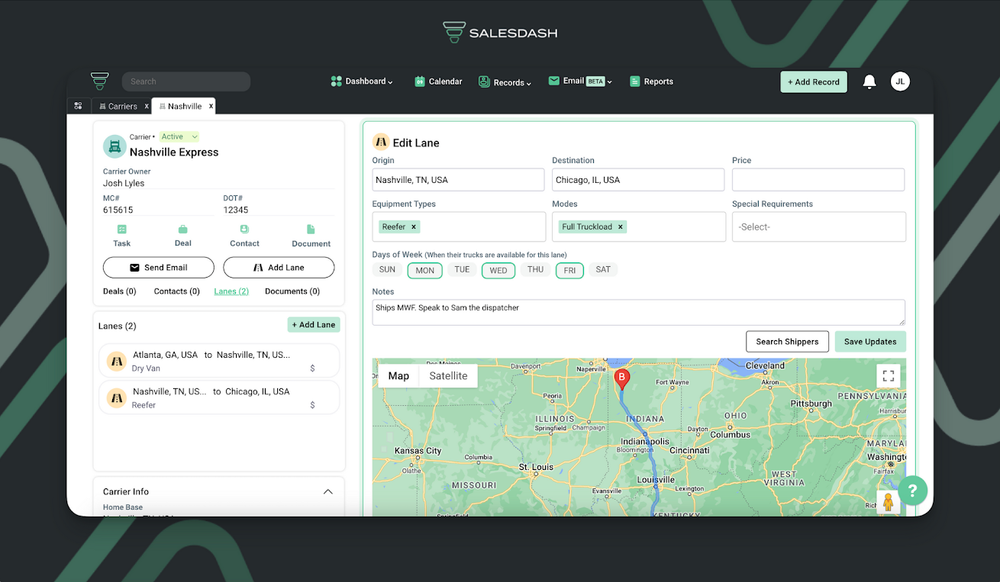

TOGETHER WITH SALESDASH CRM.

“The most user-friendly CRM our customer and carrier sales team has ever used."

Salesdash CRM is built specifically for freight brokers & 3PLs. Organize your sales outreach, notes, follow-ups, and lane profiles for your shippers and carriers.

All for an affordable price. Try Salesdash free for 14 days with no credit card required.

What Else Is Moving 🚚

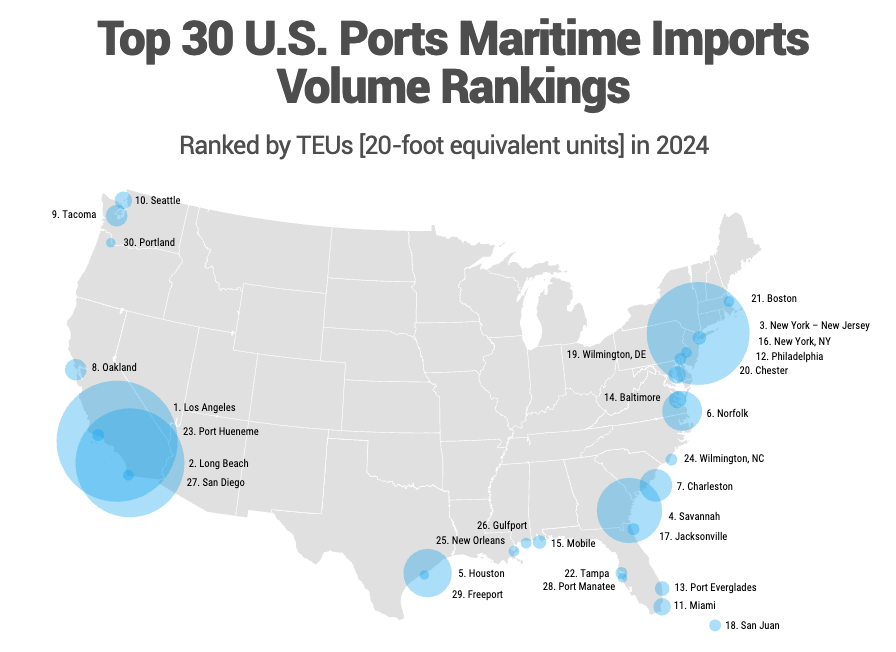

U.S Ports: 2024 Import Trends 🚢

In 2024, U.S. containerized imports surged to 28.1 million TEUs, a 12.8% increase from 2023. This represents the second-highest import volume on record, just behind the peak of 2021. Notably, import volumes were consistently above 2 million TEUs each month, signaling ongoing growth and recovery across U.S. ports.

However, the year was not without its challenges, with supply chain disruptions and geopolitical factors influencing trade patterns.

Top Performers

- Port of Los Angeles: Handled 5.36 million TEUs, up 21.4% from the previous year.

- Port of Long Beach: Saw a 25.1% increase in TEUs, reaching 4.69 million.

- Port of New York/New Jersey: Increased imports by 4.9%, totaling 4.16 million TEUs.

- Port of Savannah: Continued strong growth, rising 13.4% to 2.73 million TEUs.

- Port of Houston: With a 4.9% increase, it reached 1.9 million TEUs, showcasing growth in the Gulf Coast region.

These top ports reflect the significant role of both East and West Coast ports in managing U.S. containerized imports, with Southern California continuing to dominate.

Challenges and Declines

- Port of Portland, OR: Experienced a notable decline in TEUs due to a shift back to West Coast ports following the resolution of previous congestion issues.

- Port of Baltimore: Faced setbacks due to the collapse of the Key Bridge, which halted operations for several weeks.

Key Import Categories

- Furniture remained the highest-volume import.

- Upholstered seats and bananas saw significant growth, up by 44.4% and 93.6%, respectively.

- Photovoltaic cell imports saw a 19% decline, while PVC imports grew by 93.1%, indicating a shift in solar panel assembly to U.S. soil.

Trade with Key Partners

- China: Imports from China increased by 15.3%, maintaining its significant role in U.S. trade.

- Vietnam: Continued to gain market share, with a 28.9% increase in TEUs, making it a key alternative to China.

These dynamics show the ongoing shifts in global supply chains, as U.S. ports adapt to changes in trade policies, infrastructure, and geopolitical tensions. The diverse performance of ports highlights the resilience and adaptability of the U.S. logistics network. With ongoing global challenges, U.S. ports will continue to play a critical role in shaping the future of international trade.

FREIGHT SNIPPETS ✂️

🇨🇳 China Linked Ship Fees | The U.S. Trade Representative announced that starting mid-October, ships linked to China may face new fees, ranging from $18 per net ton to $120 per container. These fees apply to ships built in China or owned/operated by China-linked entities, with exceptions for U.S. government cargo. The move follows a year-long investigation into China's role in logistics and maritime sectors, and the fees will incentivize U.S. shipbuilding by offering exemptions for new U.S.-built vessels. Read more.

📦 Moving To NV | Universal Logistics Holdings is seeking shareholder approval to convert into a Nevada corporation, as outlined in a preliminary proxy statement. The company’s board believes Nevada offers a more favorable legal framework that could better protect directors and officers from "unmeritorious" lawsuits. Universal has been incorporated in Michigan since 2001. The filing highlights the rising risks of claims and litigation against directors and officers of public companies. Read more.

🚨 New Mexico Blitz Results | The New Mexico State Police (NMSP) Commercial Vehicle Enforcement (CVE) division recently released results from a truck blitz held from April 7 to April 11 in southeastern New Mexico. The operation aimed to improve highway safety by enforcing commercial vehicle laws, conducting inspections, monitoring weight limits, and preventing accidents caused by poorly maintained or operated vehicles. Read more.

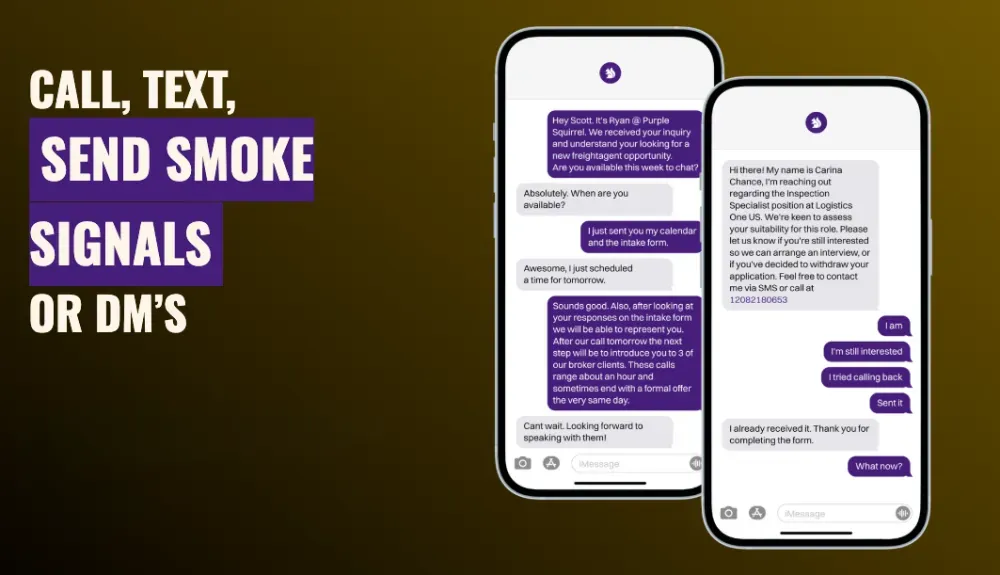

TOGETHER WITH PURPLE SQUIRREL.

Purple Squirrel represents multiple freight brokers and forwarders and connects them with top talent and opportunities. They secure multiple winning offers for agents, ensuring professionals find roles that match their skills and goals.

From FTL transportation to maritime freight forwarding , Purple Squirrel’s clients offer support, competitive commission splits and no B.S.

Ready to earn more? You have options! Explore opportunities now!

💰 $400M Tariffs | Johnson & Johnson CFO Joe Wolk announced that the company's medtech business will face a $400 million charge this year due to tariffs, primarily from China and the U.S.-Mexico-Canada Agreement. The cost includes China’s retaliatory tariffs and is mostly linked to U.S.-origin products shipped to China. These costs will be reflected in inventory and impact the P&L over time. Despite tariff challenges, J&J grew medtech sales by 2.5% to $8.02 billion in Q1 and slightly raised its 2025 sales guidance. Read more.

⏸️ Pausing B2C Shipments | DHL Express is halting B2C shipments to the U.S. over $800 starting Monday due to delays from new U.S. trade regulations. The rules, which lower the threshold for formal customs processing to $800, require additional paperwork. DHL said it’s suspending shipments “until further notice” to manage the increased backlog. Shipments under $800 and B2B shipments over $800 will still be processed but may experience delays. Read more.

🔌 Rivian's Footprint | HelloFresh has added 70 all-electric Rivian vans to its fleet, making it the first major customer since Rivian ended its exclusive deal with Amazon. These vans make up nearly a quarter of HelloFresh's fleet. Rivian opened its commercial van fleet to other companies in February 2025 after ending its Amazon exclusivity. While still producing vans for Amazon, HelloFresh is the first to publicly adopt them. Amazon has 20,000 Rivian vans in its fleet as part of its sustainability efforts. Read more.

Pallets of News 🚛

Second Trooper Guilty 🏛️

A former Massachusetts State Police (MSP) trooper has confessed to participating in a bribery scheme to falsify Commercial Driver’s License (CDL) skills test scores.

On April 11, 64-year-old Perry Mendes acknowledged his involvement in conspiracy, falsifying records, and making false statements, as reported by the U.S. Attorney’s Office for the District of Massachusetts. Mendes is the third individual to admit guilt in the case, following former Trooper Calvin Butner and civilian co-defendant Eric Mathison.

Mullen Group Acquires Cole Group 🤝🔥

Mullen Group Ltd. announced it will acquire Cole Group Inc., Cole International Inc., Abco International Freight Inc., and related entities, pending regulatory approvals. The transaction is expected to close in the second quarter, with Mullen Group funding it through existing cash and credit facilities.

The Cole Group is a full-spectrum logistics provider specializing in customs brokerage, freight forwarding, and trade consulting across Canada and the U.S. It employs over 700 people across 43 locations and offers proprietary technology solutions.

MEME OF THE DAY 😂

📍 Upcoming events: Catch up with us at the Broker Carrier Summit in Indianapolis on April 28-May 2 and Home Delivery World in Nashville on May 21-22. Let us know if you’ll be there – we'd love to connect!