Current State of Transportation: Q1 2025

Breakthrough’s State of Transportation report highlights these concerns, while also outlining trends expected to impact the freight market in 2025.

Cost concerns remain a key focus for both shippers and carriers, especially as shifting economic and political dynamics influence the transportation industry.

Breakthrough’s State of Transportation report highlights these concerns, while also outlining trends expected to impact the freight market in 2025. Feedback from 500 freight transportation leaders—including 150 carriers and 350 shippers—provides valuable insights into strategies and challenges moving forward.

Demand Growth and Rate Adjustments

According to Breakthrough’s 2025 Freight Trends research, freight demand is expected to grow year-over-year starting in May, with dry van contract rates set to increase by 3.2% and dry van spot rates by 9%. This shift is anticipated to begin in Q2 2025, signaling a market turnaround. Despite the optimism, carriers are adjusting to changing conditions, with 49% planning to expand fleet sizes and services, while 43% intend to renegotiate contracts with existing customers to stay competitive.

Shippers' Priorities

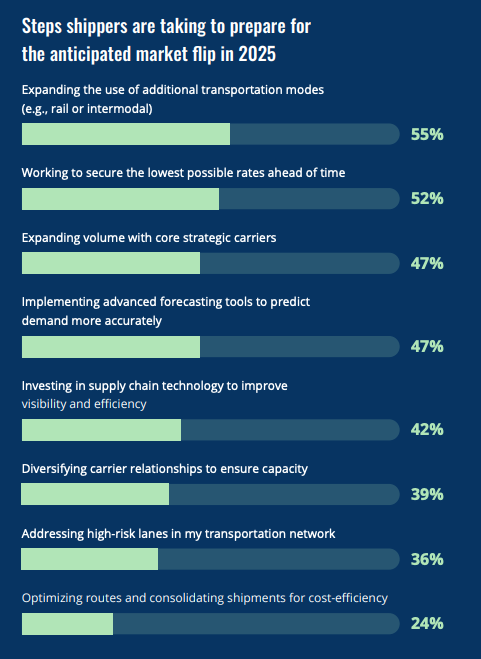

For shippers, cost remains the leading factor when selecting carriers. The report reveals that 57% of shippers prioritize cost above other factors, followed by on-time reliability (48%) and shipment schedules (37%). With economic uncertainty and rising rates, many shippers are turning to alternative transportation methods, such as rail and intermodal, with 55% of them considering an expansion of these options to optimize their networks.

Economic Pressures

The pressure of rising costs and shifting trade policies has slightly reduced the emphasis on sustainability in favor of managing immediate economic challenges. Shippers are also grappling with uncertainty around tariffs and regulatory changes, which is affecting their ability to meet sustainability goals without compromising their operations.

Key Takeaways:

- Freight Demand and Rate Growth: Freight demand is expected to grow by 1.4% in Q2 2025, with dry van rates increasing by 3.2% for contracts and 9% for spot rates.

- Shippers’ Cost Focus: 57% of shippers prioritize cost when selecting carriers, with many looking to alternative transportation modes like rail and intermodal (55%).

- Carrier Strategies: 49% of carriers are expanding fleet sizes or services, while 43% are renegotiating contracts to adapt to market changes.

- Supply Chain Challenges: 44% of respondents expect supply chain shortages, while 33% anticipate labor disruptions and regulatory changes.

- Sustainability Adjustments: Despite long-term sustainability goals, rising costs and trade uncertainties are leading shippers to adjust their focus toward economic resilience.

The freight market in 2025 will be shaped by a balance between demand growth, cost pressures, and evolving sustainability objectives, setting the stage for a more dynamic and challenging year ahead.