🚚 BlackRock

Freight Morning! 🚚 We’re starting the day with a significant development in global trade dynamics. BlackRock, the U.S. asset management firm, has made headlines with its acquisition of two key Panama Canal ports, part of a broader effort to regain control over the strategic waterway.

More on this story ahead 👇

💬 More in Freight:

⚫️ Logistics Managers' Index & Manufacturing PMI: February Trends

⚫️ Project44 vs MyCarrier: Legal Update

⚫️ Amazon Takes on LTL Market

⚫️ PODCAST: Creating A Freight Sales Mind with Nick Klingensmith

Tariffs Against Canada and Mexico 🇨🇦🇲🇽

President Donald Trump's tariffs on imports from Canada and Mexico went into effect on March 4, raising concerns of inflation and a trade war. The 25% tariff on most goods, along with a 10% tariff on Canadian energy products, has prompted retaliation from both countries, with Canada imposing tariffs on $100 billion worth of U.S. goods.

The tariffs, which were delayed for 30 days for further negotiations, aim to address drug trafficking and illegal immigration but also impact the U.S. trade imbalance. Trump's actions have sparked criticism from lawmakers, including Sen. Susan Collins (R-Maine), who expressed concern over the effect on industries in her state.

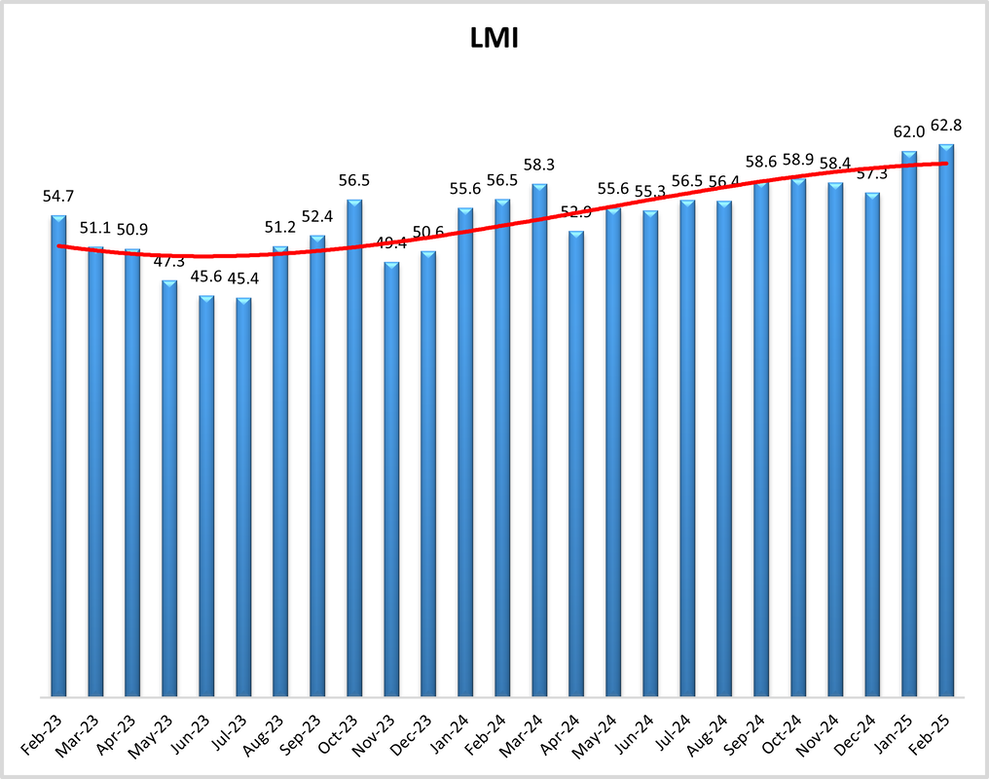

Logistics Managers' Index (LMI): February Trends 📊

The February 2025 Logistics Managers' Index (LMI) recorded a reading of 62.8, a slight increase from 62.0 in January, marking the fastest expansion since June 2022. This growth is driven by increasing inventory levels and related costs, though rising inventory is straining warehousing capacity. The market remains uncertain, partly due to shifting trade policies.

Transportation Metrics Slow Down

Transportation capacity increased (+2.5 to 55.1), but transportation utilization (-2.3 to 57.8) and prices (-4.9 to 65.5) showed signs of slowing. This suggests a static period in the market, with companies adjusting to concerns over potential trade disruptions.

Macroeconomic Impact on Supply Chains

U.S. economic activity is slowing, with consumer sentiment dropping to 64.7 in February. Tariff uncertainty, particularly regarding China, Mexico, and Canada, is contributing to this shift. Manufacturing activity is showing improvement, with the Manufacturing PMI entering expansion for the first time since October 2022.

Key Takeaways:

- Inventory Levels: Grew significantly, up to 64.8, due to tariff concerns.

- Warehouse Costs and Prices: Rose sharply, reflecting pressure from growing inventory volumes.

- Transportation Capacity: Increased to 55.1, suggesting slight easing in availability.

- Transportation Prices: Slowed, but inflationary pressures persist.

- Macroeconomic Concerns: Ongoing tariff uncertainty impacts both sentiment and trade.

The market remains uncertain due to rising inventory costs, strained capacity, and potential trade disruptions. The outlook for 2025 is mixed, with continued expansion but risks from tariff uncertainty.

REVIEW OF THE WEEK PRESENTED BY CARRIERSOURCE.

This week, we spotlight Mone Transport LLC, a trusted provider of cross-border transportation services based in Laredo, TX. With a fleet of 97, they offer dependable dry van services, ensuring smooth operations across both countries. Mone Transport has earned a 4.9/5 rating on CarrierSource from 10 reviews.

Mone Transport operates across the U.S. and parts of Mexico, with preferred lanes including routes from Kansas City, MO, Dallas, TX, and Detroit, MI to Laredo, TX, as well as cross-border shipments.

Carrier Name: Mone Transport LLC

DOT Number: 2445389

Headquarters: Laredo, TX

Fleet Size: 97

Carrier Review: They have a 4.9/5 stars on CarrierSource based on 10 reviews. A verified broker from Florida commented, "We booked Mone Transport on a dry van load out of Houston. They were responsive to our requests for status updates. No issues making appointment times. They provided a 53' swing door trailer as requested and their equipment was reliable. Excellent job by a dependable carrier."

What Else is Moving 🚚

BlackRock & The Panama Canal 💰

BlackRock has secured a $23 billion deal to take control of major Panama Canal ports, purchasing stakes from the Hong Kong-based CK Hutchison Holdings. This move follows concerns raised by President Trump about Chinese influence over the vital shipping route.

CK Hutchison announced Tuesday that it will sell its holdings in Hutchison Port Holdings and Hutchison Port Group Holdings, valued at $22.8 billion. This deal gives the BlackRock-led consortium control over 43 ports in 23 countries, including Panama's key Balboa and Cristobal ports. The consortium, which also includes Global Infrastructure Partners and Terminal Investment Limited, will acquire a 90% stake in Panama Ports Company, which operates these two crucial ports.

The Panama Canal, a 51-mile waterway linking the Atlantic and Pacific oceans, sees 40 million container ships pass through annually. It is essential to the U.S. economy, with about 70% of traffic linked to U.S. ports, while China is its second-largest user. Disputes over the canal's control first arose in 2024 when Trump accused Chinese companies of taking control of the key ports. Although the U.S. focused on Hutchison Ports, a Hong Kong-based consortium managing the key ports, the deal ensures American oversight.

Hutchison Ports had recently received a 25-year no-bid extension for managing these ports, but an ongoing audit has sparked speculation that the contract may be subject to rebidding. The BlackRock deal places the key Panama Canal ports firmly under U.S. control.

FREIGHT SNIPPETS ✂️

📄 Secure Roads and Safe Trucking Act | A new bill, HB 1569 or the "Secure Roads and Safe Trucking Act of 2025," has been introduced in the Arkansas state legislature, which would prohibit out-of-state non-domicile CDL holders and commercial learner's permit holders from operating commercial motor vehicles in the state. The bill also seeks to impound their trucks and impose a $5,000 fine per violation. Read more.

🤖 AI-Driven Solutions | KLN Group Inc. has announced plans to expand its operations with a focus on "AI-driven solutions" after securing financial backing. In a March 3 press release, the company outlined its strategy to grow its fleet, enhance logistics infrastructure, and open new terminals. Read more.

🏛️ P44 v. MyCarrier | A Delaware Chancery Court ruling on March 3rd in the legal dispute between project44 (p44) and MyCarrier yielded mixed results. Judge Kathaleen McCormick denied p44’s request for a preliminary injunction against MyCarrier’s development of software similar to p44’s LTL data services. While McCormick found no "irreparable injury" to p44, she suggested the company may prevail in arbitration. Read more.

🔋 South Carolina EV Plant | Isuzu North America Corp. announced plans to invest $280 million to establish a commercial electric vehicle assembly plant in Piedmont, South Carolina, according to a Feb. 12 release. The company purchased a 1-million-square-foot facility, which will be converted to produce gas, battery-powered N-series, and diesel-powered F-series truck models. The plant aims to have an annual capacity of 50,000 units by 2030. Read more.

🚓 California Based Forwarder Acquired | Radiant Logistics announced on Monday that it has acquired Transcon Shipping, a California-based ocean and air freight forwarder specializing in trans-Pacific trade. Transcon, headquartered in El Segundo, offers full and less-than-container-load shipments along with air and ground services from major U.S. gateways like Los Angeles, New York, and Chicago. The company’s international network mainly serves the furniture, recreational automotive, and consumer markets. The financial terms of the acquisition were not disclosed, but Radiant stated that part of the purchase price will depend on Transcon’s future performance. Read more.

📍 Houston Terminal Opens | Cross Country Freight Solutions (CCFS) has officially opened a new terminal in Houston, Texas, marking a significant expansion of its services. The new facility will enhance the company’s ability to offer reliable and efficient less-than-truckload (LTL) shipping across Texas and beyond. With the addition of the Houston terminal, CCFS aims to streamline its operations and improve service offerings for customers, facilitating faster and more cost-effective freight movement throughout the region. Read more.

NEW PODCAST 🎧

#76: Nick Klingensmith, Stride Motivation

In this episode, Nick Klingensmith shares how he went from a high-stakes sales career in logistics to completing over 100 Spartan races, marathons, and endurance events—proving that the mind is the ultimate battleground. He dives into overcoming limiting beliefs, the power of controlled adversity, and why sales professionals need to embrace discomfort to succeed.

Nick also unpacks the importance of networking in logistics, the mental endurance required for long-term success, and why patience and relentless action are key to crushing your goals. If you're in sales, logistics, or just need a push to break through your own barriers, this episode is a must-listen.

🎧 Available now on Apple, Spotify, and wherever podcasts are available.

Pallets of News 🚛

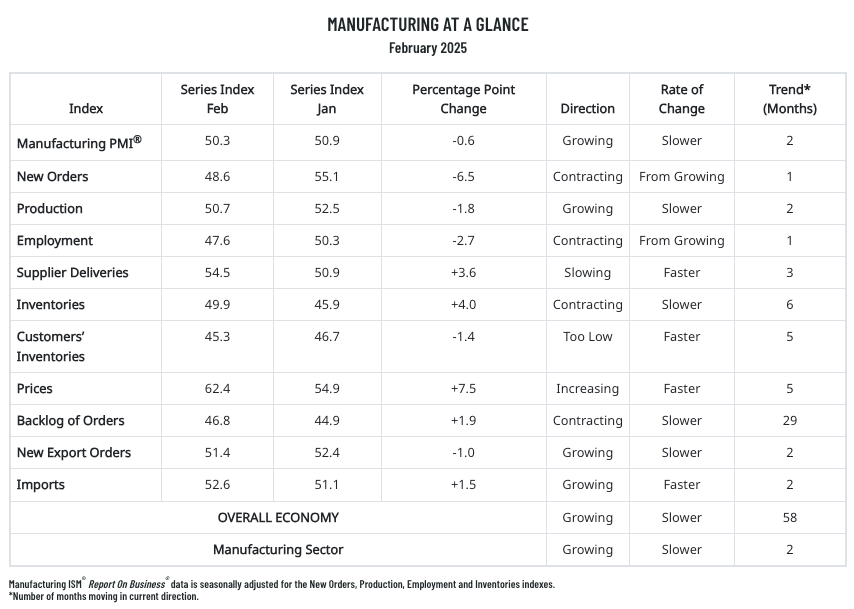

PMI: Manufacturing Trends 📈

Manufacturing production and demand increased last month, driven by companies rushing to place orders ahead of new tariffs under the Trump administration. The Institute for Supply Management (ISM) reported a slight drop in PMI to 50.3%, with price increases due to tariffs, particularly on steel and aluminum. Suppliers were reluctant to take on new orders, fearing they would bear the cost of the tariffs.

The employment index fell from 50.3% in January to 47.6% in February, as companies turned to attrition rather than layoffs. Input cost inflation reached its highest level since November 2022, confirming concerns over pricing pressures linked to tariffs.

Amazon Takes on LTL Market 🚛

Amazon plans to extend its delivery network by launching less-than-truckload (LTL) services, with a potential rollout in 2026, according to J.P. Morgan research. Job listings from Amazon further suggest an expansion of Amazon Freight’s core truckload offering, which already includes intermodal services.

While analysts at Bank of America acknowledge the potential disruption Amazon could bring to the LTL market, they also highlight risks, including the company’s possible reluctance to hire company drivers.

MEME OF THE DAY 😂