🚚 April Market Update

Freight Day! 👋 We’re starting the day with continued uncertainty in the freight market. While the U.S. has paused certain tariff increases until July 9, the broader landscape remains in flux as both shippers and carriers navigate shifting demand. More ahead 👇

💬 More In Freight:

⚫️ Tesla Electric Semi Mass Production Update

⚫️ Produce Importers Seek Tariff Clarity

⚫️ Traffic Stop Nets $9M Cocaine Bust

⚫️ PODCAST: The Shipper’s Perspective: How Beagl is Changing the Freight Sales Game with Eric Williams

Tesla Electric Semi Mass Production ⏰

Tesla announced full production of its all-electric Class 8 Semi truck will begin in 2026 at its Gigafactory in Nevada. While not discussed during the earnings call, the company confirmed the Semi is on track for volume production next year. Production was initially slated for 2019, with delays pushing it to late 2025 for initial builds.

The truck, with a 500-mile range and 81,000-pound capacity, was priced at $150,000-$180,000 in 2017. Around 200 units have been delivered, including to clients like PepsiCo. A recent report suggests potential delays and a price increase.

Tesla's Q1 revenue fell 20% year-over-year to $19.3 billion, with vehicle production and deliveries down 16% and 13%, respectively. There were no updates on the planned Monterrey, Mexico factory, with Musk pausing the project until after the U.S. presidential election.

NYC Congestion Prices 💸

New York officials have yet to comply with the deadline to halt congestion pricing in New York City, despite a "terminated approval" from the U.S. Department of Transportation (USDOT).

Congestion pricing, which began in January, charges drivers a toll for entering certain areas of the city during peak times to reduce traffic and fund public transportation improvements.

However, on February 19, the USDOT revoked its approval for the tolling plan, citing that, under federal law, highways built with federal funds cannot be tolled except under limited exceptions. The USDOT set a deadline of April 20 for New York to cease toll collection, but as of April 22, the state continued to charge drivers.

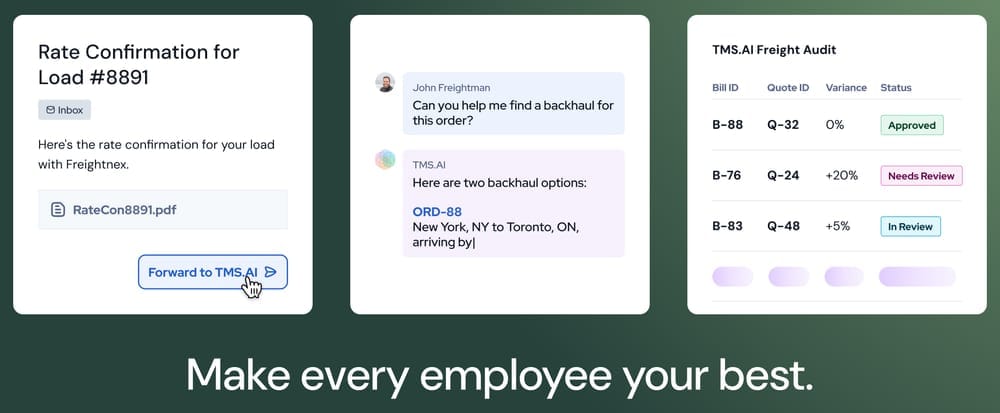

TOGETHER WITH ROSE ROCKET.

When the freight market feels unpredictable, your TMS shouldn’t. TMS.ai is the only AI-native TMS built from the ground up for modern logistics operations.

Whether you’re trying to lower operating costs, automate dispatch, or scale without hiring—TMS.ai gives you the power to do more, faster. Built by Rose Rocket, a trusted name in logistics tech.

What Else Is Moving 🚚

Arrive Logistics April 2025 Freight Market Update 📊

The freight market in April 2025 continues to be marked by significant uncertainty, driven largely by the ongoing impacts of tariffs and the overall economic climate.

While the U.S. has paused certain tariff increases until July 9, the broader freight market remains in flux, particularly as both shippers and carriers adjust to a shifting demand landscape. This uncertainty is especially apparent in cross-border shipping, where the effects of tariff-related adjustments continue to influence decision-making.

Market Volatility from Tariffs

The uncertainty surrounding tariffs remains a key driver of market volatility. While the U.S. government has temporarily paused tariff hikes on many imports, there is still a cloud of unpredictability looming over freight volumes. This has created short-term spikes in shipping activity as shippers seek to move goods before the potential tariff increases come into effect. However, the long-term outlook suggests that these fluctuations will stabilize after the summer months, as demand begins to balance out post-tariff season.

- March saw a notable increase in spot rates, particularly in flatbed services, as tariff-related freight movements increased.

- Despite tariff-induced spikes, overall demand is expected to remain cautious, with seasonal pressures in the months ahead.

Shifting Freight Demand and Capacity

As we enter the seasonal shifts, freight demand is expected to fluctuate, particularly with the onset of the produce season and the busy “100 Days of Summer.” While the market could see tightening capacity, it will not be enough to completely offset the overall downward trend in demand.

One of the key insights from the report is the ongoing slow-burn environment in the freight market. This means while we see occasional spikes in demand—often related to specific trade disruptions or seasonal factors—there’s no sustained demand boom on the horizon. Trucking employment, however, has shown growth, suggesting some stability in the workforce despite broader market disruptions.

Flatbed and Reefer Markets

Flatbed services, in particular, are seeing stronger-than-expected growth. Spot rates have risen significantly since February, and flatbed demand is expected to remain elevated throughout the summer due to continued materials demand, driven in part by tariffs on certain goods. Flatbed carriers are likely to benefit from this extended demand, making it a more resilient segment in the current freight landscape.

For refrigerated freight (reefer), the market has shown typical seasonal movements, but rates have held steady above last year's levels, with some upward pressure. As for dry van freight, while it’s near seasonal lows, the gap between spot and contract rates is widening, further indicating the continuing impact of tariff uncertainty.

- Spot rates for flatbeds are up by $0.16/mile since February—an indication of the increasing demand for these services in the wake of tariffs.

- Reefer rates are approaching seasonal floors but are still ahead of last year’s levels.

Cross-Border Shipping: Mexico and Canada

Shipping from Canada has been slow, particularly in the wake of the recent tariff actions. The political landscape in Canada, especially with elections approaching, is adding complexity to freight movements. Mexico, too, is seeing tight capacity, particularly in the Bajío region, which is heavily tied to automotive manufacturing. Delays at key U.S.-Mexico border crossings, such as Laredo and El Paso, have also been slightly higher, contributing to the challenges faced by cross-border shippers.

Both Mexico and Canada are facing distinct challenges. In Mexico, rising demand for automotive shipments and border congestion are creating tight conditions. Meanwhile, Canada’s retaliation measures against U.S. tariffs are contributing to slowdowns, with particular impact on agricultural and raw material exports.

Looking Ahead

Despite some signs of stability in consumer spending, inflation and tariff-driven disruptions are expected to keep the freight market in a state of flux for the foreseeable future. While the labor market remains steady, the economic uncertainty driven by tariffs continues to cloud the outlook for the rest of 2025. The shifting trade policies, alongside potential changes to logistics networks, will create challenges for businesses trying to balance costs with growth.

FREIGHT SNIPPETS ✂️

📉 Produce Importers Seek Clarity | Anthony Serafino, president of Exp Group, discussed the impact of tariffs on the fresh produce industry, noting that the lack of clarity from the U.S. administration has led to "volatility." He expressed concerns about rising duty prices and their effect on commodities, particularly fresh produce, which has become more expensive due to tariffs and a weakening dollar. Read more.

🔥 Semi Hauling Paint Catches Fire | Indiana State Police reported a fire on I-65 South near the 231 mile-marker, caused by a mechanical issue on a 2021 Volvo truck operated by Swift Transportation. The driver noticed glowing brakes that caught fire, spreading quickly to the trailer and its cargo of paint cans, which intensified the flames. The fire spread to trees and the road, prompting a hazmat response. Read more.

💍 Jewelry Shipment Seized | U.S. Customs and Border Protection officers at the El Paso port of entry recently intercepted a shipment of counterfeit jewelry valued at $9.2 million if authentic. The shipment, originating from China and headed to an El Paso residence, contained 1,708 fake items resembling the luxury Van Cleef & Arpels "Alhambra" collection. The seizure, confirmed with the trademark holder, occurred on April 9 and was authorized on April 21. The shipment, declared as accessories and bracelets worth $15,480, was seized, and the investigation is ongoing. Read more.

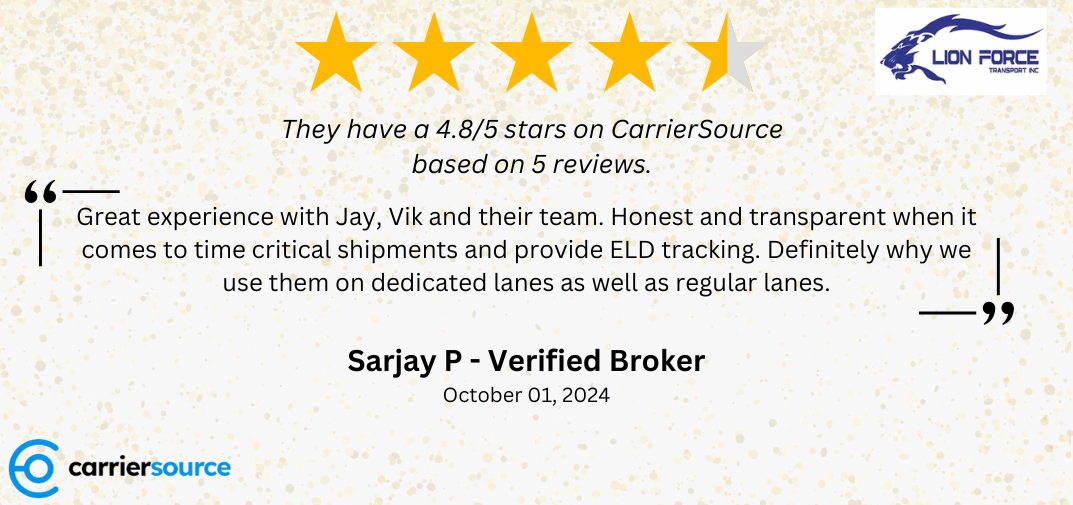

REVIEW OF THE WEEK PRESENTED BY CARRIERSOURCE.

Lion Force Transport: Review Of The Week 🏆

This week, we spotlight Lion Force Transport, a reliable carrier based in Mississauga, ON. With a fleet of 227, Lion Force Transport understands that each client has unique needs, and they work closely with clients to deliver tailored transportation solutions.

Operating across the United States and into Ontario and Quebec, their preferred lane includes the route from Woodstock, ON to El Paso, TX. Lion Force has earned a 4.8/5 rating on CarrierSource from 5 reviews.

DOT Number: 2902802

Headquarters: Mississauga, ON

Fleet Size: 227

CarrierSource Profile Link

📉 Truck Tonnage Dips | The U.S. freight market slowed in March after a strong February, with truck freight tonnage dropping 1.5%, according to the American Trucking Associations (ATA). However, Q1 2025 data shows a slight positive trend, with a 0.2% year-over-year increase. "Solid manufacturing output, particularly in auto production, helped stabilize tonnage," said ATA Chief Economist Bob Costello. The non-seasonally adjusted index saw a 9.5% increase from February. Despite a slight gain in Q1, uncertainty remains due to fluctuating tariffs, with some paused but others, including those on China and steel/aluminum, still in place. Read more.

🤝 Funko Hires Supply Chain SVP | Funko has appointed Cliff Engle as Senior Vice President of Distribution, Logistics, and Operations, effective April 7. Engle, with over 25 years of supply chain experience, will oversee global distribution, including the U.S. and U.K. facilities. Previously, he held leadership roles at Amazon, The Home Depot, and PetSmart. Funko CEO Cynthia Williams highlighted Engle's leadership during challenging supply chain changes, including tariff impacts. Read more.

🥷 How Cargo Theft Is Overwhelming The Supply Chain | Cargo theft cost businesses over $454 million in 2024, targeting high-value goods like food, electronics, and pharmaceuticals. Criminals use methods like hijacking, warehouse theft, and insider collusion. The fallout includes delayed shipments, higher insurance, and reputational damage, with consumers facing higher prices. Companies are investing in GPS tracking, AI, and blockchain, but criminals are evolving. Watch now.

NEW PODCAST 🎧

#80: Eric Williams, Beagl

In this episode of the ThinkFreight podcast, Thomas Werdine sits down with Eric Williams, co-founder and CEO of Beagl, to explore his unique journey from financial markets to freight brokerage. They dive into the challenges faced by brokers versus shippers, the importance of understanding the shipper’s perspective, and how to optimize freight operations.

Eric shares valuable insights on the role of contracts and how to foster successful partnerships in logistics. They also discuss the importance of specificity in brokerage services and building strategic relationships between brokers and shippers.

Then, Eric introduces Beagl, a cutting-edge tool that transforms the RFP process using data and automation. Plus, hear about feedback from early Beagl users and what the future of freight sales looks like as technology continues to evolve.

🎧 Also available on Apple, Spotify, and wherever podcasts are available.

Pallets of News 🚛

ABF Deploys Additional Electric Terminal Tractors 🔋

ABF Freight (an ArcBest company) is expanding its fleet with five more Orange EV electric terminal tractors, bringing its total to 14. The company first deployed Orange EV trucks in June 2022 and is confident in the benefits of transitioning to electric power. ABF joins companies like YMX and DHL in using Orange EV trucks, which have logged hundreds of thousands of service hours.

Traffic Stop Nets $9M Cocaine Bust 🚔

Tennessee authorities recently seized nearly $9 million worth of cocaine from a tractor-trailer initially stopped for a traffic violation. The seizure occurred on the evening of April 15 on I-40 in Haywood County. Agents with the Criminal Interdiction Unit pulled over the semi truck for a traffic violation, and during the stop, they noticed irregularities in the vehicle.

A canine unit was deployed, and after the dog alerted to drugs, agents conducted a four-hour search. They discovered two hidden compartments near the trailer's refrigeration unit, containing 90 kilos of cocaine, weighing approximately 200 pounds. The cocaine, valued at $2.25 million wholesale, has an estimated street value of $9 million.

MEME OF THE DAY 😂

📍 Upcoming events: Catch up with us at the Broker Carrier Summit in Indianapolis on April 28-May 2 and Home Delivery World in Nashville on May 21-22. Let us know if you’ll be there – we'd love to connect!