🚚 AI-Insurance

Freight Day! 🚚 We’re starting the day with some news in the trucking tech space. Nirvana, an AI-driven insurance platform for truckers, has raised $80 million in Series C funding.

The platform, which leverages real-time telematics and extensive truck driving data to manage insurance policies, plans to use the funds to expand its services. More ahead 👇

💬 More in Freight:

⚫️ February Container Import Trends

⚫️ FMCSA Acting Administrator Appointed

⚫️ Class-8 Trucking Orders Decline

⚫️ $20M Liquid Meth Bust at Border

February Container Imports 📊

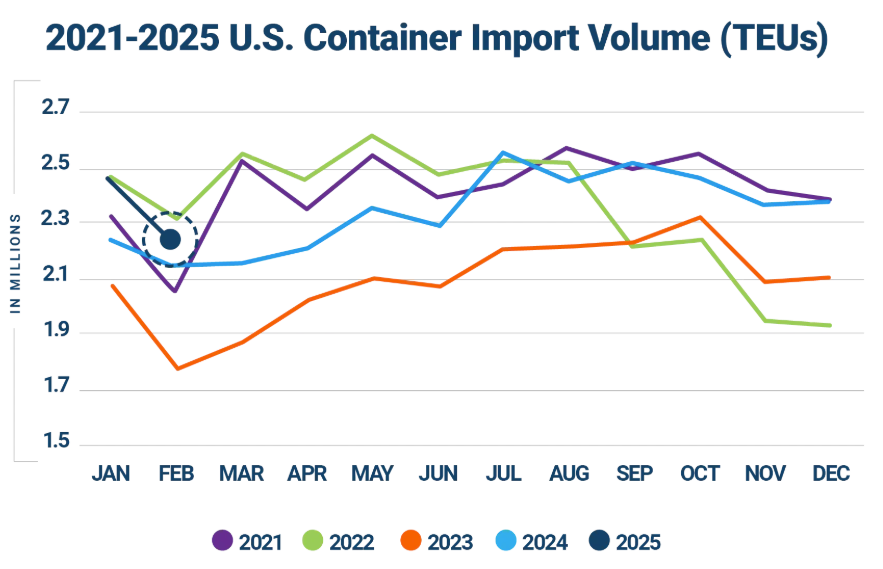

According to Descartes’ March logistics update, U.S. container import volumes remained strong despite the typical seasonal decline, but the global supply chain faces increased uncertainty due to shifting trade policies and geopolitical issues. These challenges suggest potential disruptions ahead.

U.S. container imports in February decreased by 10% compared to January, totaling 2,238,942 TEUs, but showed a 4.7% increase from the previous year. The month’s volume was the second-highest for February, falling just 73,341 TEUs short of February 2022. The drop was expected due to the shorter month and typical seasonal declines.

Imports from China experienced a notable 12.5% decline from January, reaching 872,779 TEUs. This drop was influenced by the Chinese Lunar New Year and the implementation of a 10% tariff starting February 4. However, compared to February 2024, imports from China rose by 7.9%, signaling ongoing demand. The introduction of an additional 10% tariff in March may add volatility for future imports from China.

Among the top 10 U.S. ports, February container imports dropped by 11.2% from January, with significant reductions at Long Beach (down 24.7%), Los Angeles (down 15.7%), Houston (down 14.9%), and Norfolk (down 11.0%). Savannah and Charleston were the only ports to see increases, with volumes rising by 9.8% and 10.6%, respectively.

KAL Freight Bankruptcy Update 🏛️

KAL Freight's bankruptcy case is nearing a critical stage, with motions filed in Texas court. The company is struggling to reorganize under Chapter 11, with two possible outcomes: a liquidation plan or conversion to Chapter 7.

Despite having over 800 loads on the road, creditors are concerned that a quick Chapter 7 conversion could leave trucks and cargo stranded. Unsecured creditors are pushing for rapid liquidation, while Triumph Financial and Daimler are seeking a three-week delay to avoid chaos.

KAL Freight is also facing allegations of improper business practices, including moving trucks to Canada and questionable accounting, contributing to its financial troubles and legal issues with creditors.

REVIEW OF THE WEEK PRESENTED BY CARRIERSOURCE.

ITF GROUP 🏆

This week, we spotlight ITF Group, a premier logistics provider founded in 2012 and headquartered in Hazelwood, MO. Specializing in managing full truckload (FTL) and less-than-truckload (LTL) shipments across the U.S. and Canada, ITF Group is known for its modern fleet, cutting-edge technology.

With a fleet size of 119, their services are powered by satellite tracking to ensure safe, efficient deliveries. ITF Group has earned a 4.8/5 rating on CarrierSource from 26 reviews.

ITF Group operates across both the U.S. and Canada, with preferred lanes including routes from Fort Worth, TX to Atlanta, GA, Edison, NJ to Hazelwood, MO, and Chicago, IL to Hazelwood, MO.

Carrier Name: ITF Group

DOT Number: 2096411

Headquarters: Hazelwood, MO

Fleet Size: 119

Carrier Review: They have a 4.8/5 stars on CarrierSource based on 26 reviews. A verified broker from Ohio commented, "Top carrier! One of the best carrier's I've worked with. Communication from dispatcher and Maruf was solid, they were able to provided updates about the load whenever needed. Driver was early to both pick up and delivery appointments. Also tracking went smoothly throughout the entire haul. Highly recommend this carrier!"

What Else is Moving 🚚

AI-Powered Insurance 🤖

Nirvana, an AI-driven insurance platform for truckers, has raised $80 million in Series C funding to expand its services for both fleets and individual drivers. This latest investment brings the company's valuation to $830 million, more than doubling its previous valuation of $350 million from October 2023.

Leveraging Data

The platform uses real-time driving telematics and over 20 billion miles of truck driving data to manage insurance policies. With the new funds, Nirvana plans to enhance its offerings and grow its presence in the trucking industry. The investment round was led by General Catalyst, with additional participation from Lightspeed Venture Partners and Valor Equity Partners.

Nirvana’s growth is fueled by the rapid expansion of the U.S. trucking industry, which generated over $900 billion in 2024 and is projected to reach $1.46 trillion by 2035. However, challenges such as the potential impact of tariffs on cross-border freight could push trucking businesses to focus more on cost efficiency—a space where Nirvana’s insurance platform can make a difference.

The Future of Trucking

Nirvana’s platform offers a "pay as you drive" model that incorporates safety data from telematics and federal regulatory data, helping trucking businesses save on insurance premiums while improving safety. The company’s AI-powered tools speed up claims processing and provide quicker quotes compared to traditional insurers, making the process more efficient for customers.

The company aims to capitalize on advancements in cloud computing, AI, and connected vehicles to streamline insurance for the trucking industry. As the trucking sector continues to attract tech startups, Nirvana is positioning itself as a key player in transforming the future of insurance for trucking.

FREIGHT SNIPPETS ✂️

💰 Real-Time Updates | Bison Transport has improved its cross-docking operations by introducing printable and scannable barcodes using Scanbot scanners on Samsung tablets. This upgrade allows drivers to track pallets and provide real-time customer updates. The Winnipeg-based carrier, with operations in Canada, Mexico, and the U.S., partnered with a German software company to digitize paperwork. Read more.

🤝 FMCSA Acting Administrator | Adrienne Camire has been appointed as the acting administrator of the Federal Motor Carrier Safety Administration (FMCSA). With over 20 years of experience, Camire previously served as chief counsel for the Federal Highway Administration and senior adviser to the FMCSA administrator under President Trump. Read more.

🌽 Corny Accident | A semi-truck carrying corn overturned on Interstate 75 in Georgia on Monday, leading to lane closures. The incident took place on I-75 Southbound at mile marker 337 in Whitfield County, according to the Whitfield County Sheriff’s Office. Two lanes were blocked while crews worked to remove the truck and clear the spilled corn. Fortunately, no injuries were reported. Read more.

🔋 EV Charging Infrastructure Deal | V Realty Inc. has acquired a strategic portfolio from Gage Zero, an Austin-based company specializing in fleet electrification and infrastructure development for regional and drayage trucking fleets. The acquisition combines EV Realty’s infrastructure expertise with Gage Zero’s strong customer relationships, expanding opportunities for electrification and cost reduction in commercial fleets. Patrick Sullivan, EV Realty’s co-founder, noted that the merger will help customers plan around electrification and open new freight lanes. Zeina El-Azzi, Gage Zero’s CEO, emphasized the complementary nature of the two companies’ approaches. Read more.

💵 $10B Pledge | Siemens is making a major commitment to U.S. manufacturing and AI, with over $10 billion in new investments. The company is opening new factories, expanding its workforce, and enhancing its position in industrial technology. As part of this initiative, Siemens is establishing two new manufacturing plants in Fort Worth, Texas, and Pomona, California, creating more than 900 skilled jobs. The $285 million expansion will significantly increase Siemens' production capacity for electric equipment used in AI data centers and other sectors. Read more.

📉 Truck Orders | Class 8 truck orders in North America continued to decline in February, down 34% year-over-year to 18,300 units, and 29% lower than January, according to ACT Research. This marks a continued trend of weak order activity since December's uptick. Seasonally adjusted orders also fell 28% to 16,700 units, the lowest in nearly two years. Mack Trucks remains optimistic, citing strong demand in the vocational segment despite the overall decline. Meanwhile, FTR Transportation Intelligence reported a 38% drop in February’s Class 8 net orders to 17,000 units, reflecting slow business investment amid tariff concerns and market uncertainty. Read more.

Pallets of News 🚛

Liquid Meth Seized at Border 🚔

U.S. Customs and Border Protection (CBP) officers at the Roma Port of Entry recently intercepted a massive shipment of liquid methamphetamine worth over $20 million.

The drugs were concealed in more than 1,600 water bottles inside a tractor-trailer, which was also carrying chili peppers, potatoes, and onions. This seizure, which took place at the Roma International Bridge in Roma, Texas, highlights the collaboration between U.S. and Mexican authorities to combat drug smuggling.

Aurora Remains Optimistic 🤖

Aurora is optimistic that President Trump’s administration, with support from Transportation Secretary Sean Duffy, could establish a national framework for autonomous vehicles (AVs), helping streamline regulations and promote AV deployment. CEO Chris Urmson highlighted the administration's focus on innovation and safety as key factors for a favorable regulatory environment.

Aurora is set to launch driverless operations in Texas this April, starting with one truck on the Houston to Dallas route. The company plans to expand to 10 trucks and enhance capabilities for night and rainy conditions later in the year. While most states allow AV operations, Urmson emphasized the need for a national standard to address the current patchwork of regulations.

MEME OF THE DAY! 😂