🚚 Acquisitions, Layoffs, and Tariffs

Freight Day! 👋 We’re diving into the latest in freight brokerage M&A, as 2025 heats up with FitzMark acquiring refrigerated brokerage HPL and LTL broker Pentonix Freight. With nine acquisitions since 2006, FitzMark continues to expand its reach in refrigerated and LTL transportation.

Additionally, the Trump administration is set to impose a 20.91% tariff on Mexican tomatoes starting July 14. More ahead 👇

💬 More In Freight:

⚫️ Tomatoes From Mexico

⚫️ Stealing $4M From A New Jersey Trucking Company

⚫️ J.B. Hunt Profit Tumbles

⚫️ Kodiak Robotics Going Public

Tomatoes From Mexico 🍅

The Trump administration plans to withdraw from a trade agreement that allows Mexican tomatoes to enter the U.S. duty-free, imposing a 20.91% tariff starting July 14. The Commerce Department cited concerns from U.S. tomato growers about unfair competition from Mexican imports.

Under the current agreement, Mexican tomatoes are regulated by the Commerce Department, which sets minimum pricing. The 2019 deal, which resolved a tariff dispute, required Mexican producers to sell tomatoes above a reference price to avoid tariffs. Mexico exports over half its tomatoes to the U.S., totaling $2.7 billion in 2023.

Stealing $4M From NJ Trucking Company 💵

A New Jersey woman has confessed to stealing approximately $4 million from her employer, West End Express, a trucking company, to fund her gambling addiction.

Jeanette Avellan, who worked as a bookkeeper for the company, acknowledged her involvement in second-degree theft, third-degree failure to pay income taxes, and third-degree filing a fraudulent tax return. The theft took place between January 2017 and January 2023. Avellan also failed to report the stolen funds as income on her tax returns.

TOGETHER WITH ROSE ROCKET.

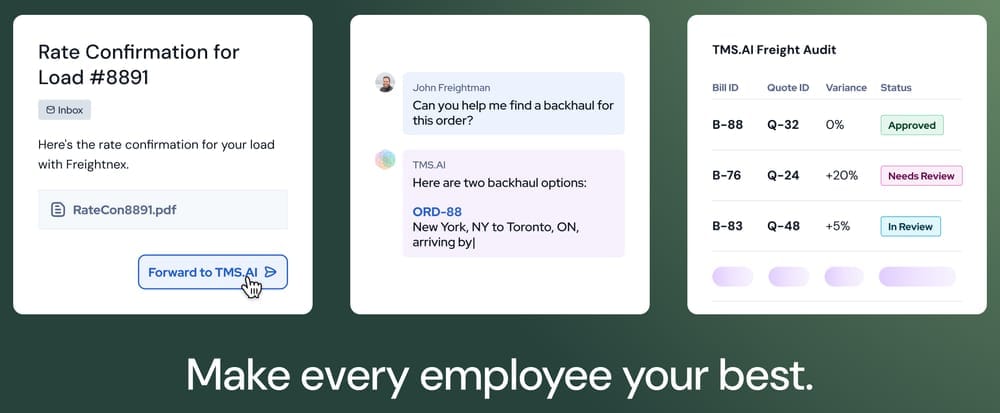

When the freight market feels unpredictable, your TMS shouldn’t. TMS.ai is the only AI-native TMS built from the ground up for modern logistics operations.

Whether you’re trying to lower operating costs, automate dispatch, or scale without hiring—TMS.ai gives you the power to do more, faster. Built by Rose Rocket, a trusted name in logistics tech.

What Else Is Moving 🚚

FitzMark Acquires Two Brokerages 🤝

FitzMark announced the acquisition of refrigerated brokerage High Point Logistics (HPL) and less-than-truckload broker Pentonix Freight on Monday. Financial terms of the deals were not disclosed. With these acquisitions, FitzMark has now acquired nine companies since its founding in 2006.

“HPL and Pentonix strengthen our capabilities in refrigerated, LTL, and managed transportation and align with our service-focused, high-reliability model,” said Scott Fitzgerald, FitzMark’s founder and CEO.

FitzMark, based in Indianapolis, provides brokerage services and a proprietary TMS, serving over 3,000 shippers and 25,000 carriers. The company is backed by Calera Capital.

HPL and Pentonix are located in Jackson, Tennessee, and Fort Worth, Texas, respectively.

FREIGHT SNIPPETS ✂️

📉 J.B. Hunt Profit Tumbles | J.B. Hunt Transport Services reported mixed results for the intermodal bid season, with rate increases and added volume in some areas, while losing business in others. The company faced a shifting tariff landscape, with about 20% to 30% of its intermodal volume coming from the West Coast. Revenue decreased by 1% to $2.92 billion, with operating income falling 8% to $179 million due to higher costs. Intermodal revenue rose 5% to $1.47 billion, driven by record volumes, but revenue per load declined 2%, impacted by shorter hauls in the East. The segment’s operating ratio worsened by 90 basis points to 93.6%. The dedicated segment experienced a 4% revenue decline, while the brokerage unit saw a 6% revenue decrease but a smaller operating loss. Shares of J.B. Hunt fell 5.8% in after-hours trading. Read more.

🛑 Ocean Shipments From China Halted | Several global brands have paused ocean shipments from China as they assess trade lane developments, said Gene Seroka, Executive Director of the Port of Los Angeles, during an April 11 briefing. The ongoing U.S.-China tariff escalation has created significant uncertainty. The Trump administration’s new 125% tariffs on Chinese imports were met with a retaliatory 125% tariff from China. This has led shippers to delay shipments due to inflated costs. Read more.

🇲🇽 Mexico Halts Fuel Imports | Fuel shipments from Texas to Mexico have come to a standstill due to a Mexican government crackdown on import tax payments. For the past two weeks, the Texas-Mexico land crossing has been effectively closed for trucks carrying fuel products like gasoline and diesel, as the government has increased cargo inspections. One unnamed fuel distributor reported a sharp drop in business, with demand plummeting overnight after the inspections were intensified. Mexico is the leading destination for U.S. fuel, with 1.15 million barrels of petroleum products crossing the border daily as of January, according to the U.S. Energy Information Administration. Read more.

REVIEW OF THE WEEK PRESENTED BY CARRIERSOURCE.

ERL Intermodal Corporation: Carrier Review Of The Week 🏆

This week, we spotlight ERL Intermodal Corporation, a trusted provider of intermodal drayage services headquartered in Utica, NY. Specializing in hauling freight to and from the East Coast Ports of New York and New Jersey, ERL Intermodal connects businesses across Upstate New York to these critical shipping hubs on a daily basis.

With a fleet of 43, ERL ensures safety and efficiency by equipping all of their trucks with GPS tracking for real-time monitoring. They have earned a 4.7/5 rating on CarrierSource from 13 reviews.

DOT Number: 2257949

Headquarters: Utica, NY

Fleet Size: 43

🚓 $14M Meth Caught With Peppers | Customs and Border Protection (CBP) agents recently intercepted a drug shipment at the Pharr International Bridge cargo facility in Texas. On April 11, CBP officers discovered $14.6 million worth of suspected methamphetamine hidden in a shipment of fresh bell peppers and cucumbers. The tractor trailer, entering from Mexico, was referred for further inspection after a routine check. Utilizing nonintrusive inspection equipment and a canine team, officers found 300 packages of the drug, weighing a total of 1,635.56 pounds. Read more.

🚛 Self-Driving Trucks In Ohio and Indiana | Two semi-trucks using automated platooning technology have started deliveries on Interstate 70 between Columbus, Ohio, and Indianapolis, Indiana, as part of a project led by the Ohio and Indiana Departments of Transportation. The initiative tests self-driving truck technology in real-world Midwestern conditions. Operated by EASE Logistics, the trucks use platooning technology from Kratos Defense, which links two trucks electronically to allow the lead vehicle to control both trucks' speed and direction. The second truck follows autonomously, with human drivers in both trucks ready to take control at any time. Read more.

📉 Spot Loads Drop | DAT One saw a 19.3% week-over-week drop in load postings to 2.1 million, but the number of loads moved reached a record high for week 15. Truck posts rose 2.8% as truckers responded to weekly demand fluctuations. Read more.

Pallets of News 🚛

GM Temporary Layoffs ⏸️

General Motors has temporarily laid off 700 workers in the U.S. and Canada due to reduced demand for electric vehicles. The layoffs affect employees at GM's Factory Zero in Detroit and its CAMI Assembly plant in Ingersoll, Ontario.

At Factory Zero, 200 workers are impacted as production adjusts to market conditions. In Ingersoll, 500 workers are laid off due to lower demand for BrightDrop electric delivery vans, with plans to retool the plant for future commercial electric vehicle production.

These layoffs follow similar actions by Stellantis, which temporarily laid off 900 workers due to tariffs imposed by the Trump administration.

Kodiak To Go Public 📊

Kodiak Robotics has reached an agreement with Ares Acquisition Corp. II (AACT) to go public, valuing the company at $2.5 billion. The deal is backed by institutional investors, including Soros Fund Management, ARK Investments, and Ares, with $110 million in financing and $551 million in cash from Ares' trust.

Founded in 2018 by Don Burnette, Kodiak specializes in autonomous trucking technology and has a first-to-market driverless truck operation. The company works with partners like Atlas Energy Solutions, Bridgestone, and J.B. Hunt, and holds a $30 million Department of Defense contract.

Kodiak's business model offers autonomous trucks on a per-mile or per-truck basis. The autonomous freight market is expected to reach $1 trillion in the U.S. and $4 trillion globally.

MEME OF THE DAY 😂

📍 Upcoming events: Catch up with us at the Broker Carrier Summit in Indianapolis on April 28-May 2 and Home Delivery World in Nashville on May 21-22. Let us know if you’ll be there – we'd love to connect!