2025 Top 10 Logistics Companies

The 2025 rankings for North America's largest logistics companies, including freight brokerages, 3PLs, and other logistics service providers, have seen a dynamic shift.

The 2025 rankings for North America's largest logistics companies, including freight brokerages, 3PLs, and other logistics service providers, have seen a dynamic shift. Companies are scaling up through acquisitions, diversifying service offerings, and adjusting to a more competitive market.

The Transport Topics Top 100 Logistics Companies list highlights the industry's top players and the biggest moves of the year.

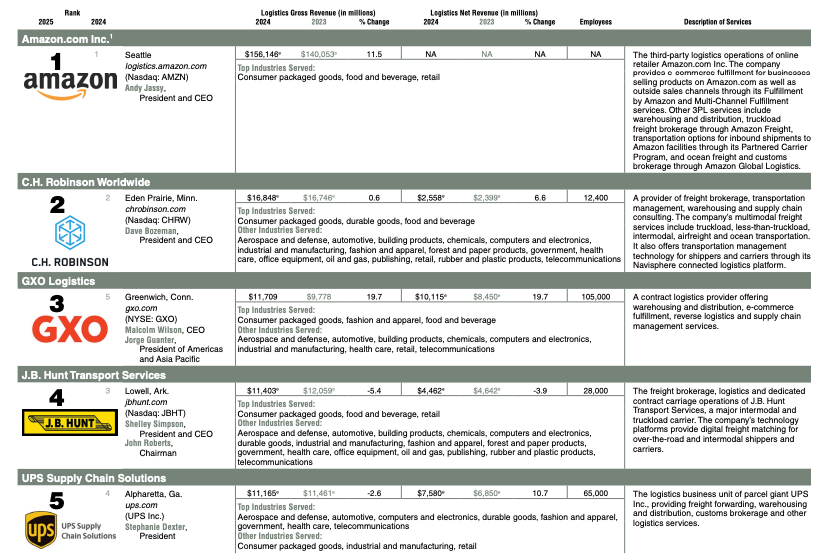

Top 10 Companies of 2025:

- Amazon – $156.1B

Amazon continues to dominate not just e-commerce but logistics as well, with its vast network of fulfillment centers and supply chain capabilities. The company’s logistics revenue continues to skyrocket as it broadens its logistics footprint globally. - C.H. Robinson Worldwide – $16.8B

C.H. Robinson remains a leader in the logistics space, maintaining a stronghold in freight brokerage, supply chain management, and a diversified range of freight services. - GXO Logistics – $11.7B

GXO continues to build on its position as a leading contract logistics provider, with impressive revenue growth driven by its global supply chain management and warehousing solutions. - J.B. Hunt Transport Services – $11.4B

J.B. Hunt ranks No. 4, buoyed by its growth in intermodal services, truckload solutions, and strong performance in the freight brokerage sector. - UPS Supply Chain Solutions – $11.2B

UPS continues to expand its logistics footprint with extensive services in freight forwarding, warehousing, and supply chain management, securing its spot in the top five. - Expeditors International of Washington – $10.6B

Expeditors holds steady in the sixth position with its integrated logistics services, focusing on freight forwarding, customs brokerage, and international logistics. - Ryder System – $7.7B

With a strong presence in supply chain management, fleet management, and logistics services, Ryder continues to show robust performance in the logistics sector. - Kuehne + Nagel (North America) – $7.2B

The global logistics provider maintains a steady presence, bolstered by its international freight forwarding services, particularly in air and sea freight. - Total Quality Logistics (TQL) – $6.9B

TQL continues to thrive in North America, with consistent growth across dry van truckload, refrigerated freight, and LTL, maintaining a stronghold in the brokerage sector. - Armada Sunset Holdings – $5.8B

Armada has made significant strides in its logistics operations, expanding its footprint in freight brokerage and becoming a formidable player in the North American logistics market.

Notable Movers

Some companies have made impressive gains, thanks to strategic acquisitions, service diversification, or rapid growth:

- RXO – $4.6B

RXO, following its split from XPO, saw substantial growth thanks to its acquisition of Coyote Logistics, jumping to the 16th position. This acquisition has strengthened its position in the brokerage and less-than-truckload services. - Scotlynn – $1.7B

Scotlynn made a remarkable leap, moving from No. 70 to No. 40 on the list. The company’s rapid growth in refrigerated and truckload services is a testament to its strategic expansion. - Kerry Logistics Network (Americas) – $1.95B

Kerry Logistics, with its increasing footprint in global logistics, has gained ground, making a notable rise in the rankings.

Biggest Drops

Several logistics companies faced challenges in maintaining their previous rankings:

- Ascent Global Logistics – Dropped from No. 46 to No. 50

Ascent’s decline reflects issues with scaling its operations effectively, particularly in adapting to the changing demands of the freight brokerage market. - Redwood Logistics – Dropped from No. 50 to No. 53

Despite being a recognized name in the industry, Redwood faced challenges that led to a drop in both revenue and position on the list. - Werner Enterprises – Dropped from No. 32 to No. 36

Werner saw a slight decline this year, as its focus on over-the-road trucking struggled to match the scale and diversification of other players. - Penske Logistics – Dropped from No. 19 to No. 24

Penske’s ranking decline shows how the company has faced challenges scaling its supply chain management services amid more aggressive competition from global players.

Looking Ahead

The 2025 rankings show a market where growth is driven by acquisitions, technological advancements, and the ability to diversify services. RXO and Scotlynn stand out as major success stories, leveraging acquisitions and scaling their operations to rapidly expand their market share.

On the flip side, companies like Redwood Logistics and Ascent Global Logistics illustrate the challenges companies face in a competitive market, where slow growth or failure to adapt can lead to significant drops.