🚚 2025 State of Transportation

Freight Day! 🚚 Happy St. Patrick's Day! ☘️ We’re starting the week with a deep dive into cost concerns still facing the freight industry. According to Breakthrough’s State of Transportation report, shifting economic and political dynamics continue to impact both shippers and carriers, with cost management remaining a top priority.

More on this report ahead 👇

💬 More in Freight:

⚫️ Summer Container Import Uncertainty

⚫️ Widespread Spring Storms Impact Freight

⚫️ U.S. States That Import The Most From Canada and Mexico

⚫️ PODCAST: Beyond Nearshoring: Building An Ecosystem For Logistics with Mia Mazal

51 Year Old Michigan Trucking Company Halts Operations ❌

Equity Transportation Co. Inc., based in Walker, Michigan, has shut down operations, laying off all drivers and halting its fleet. Drivers report waiting for final wages, with some facing bounced checks. The company has not publicly addressed the closure, and many contact numbers have been deactivated.

Before the closure, the company faced financial trouble, including a high-risk credit warning and operational challenges such as hours-of-service violations and accidents.

Summer Container Import Uncertainty 🏗️

U.S. container imports are expected to stay high through spring but could decline year-over-year this summer, according to the latest Global Port Tracker report from NRF and Hackett Associates. Ongoing tariff concerns, particularly on Chinese imports, continue to affect strategies. Retailers are rushing to bring in merchandise before tariffs rise, but these costs ultimately impact American consumers.

February retail spending dropped slightly month-over-month due to weather and tariffs but grew 3.38% year-over-year. Proposed U.S. port tolls on Chinese ships could further increase supply chain costs and disrupt shipping patterns, putting more pressure on major ports and smaller hubs.

TOGETHER WITH SALESDASH CRM.

Salesdash CRM is built specifically for freight brokers & 3PLs. Organize your sales outreach, notes, follow-ups, and lane profiles for your shippers and carriers.

All for an affordable price. Try Salesdash free for 14 days with no credit card required.

What Else is Moving 🚚

2025 Current State of Transportation 📊

Cost concerns remain a key focus for both shippers and carriers, especially as shifting economic and political dynamics influence the transportation industry.

Breakthrough’s State of Transportation report highlights these concerns, while also outlining trends expected to impact the freight market in 2025. Feedback from 500 freight transportation leaders—including 150 carriers and 350 shippers—provides valuable insights into strategies and challenges moving forward.

Demand Growth and Rate Adjustments

According to Breakthrough’s 2025 Freight Trends research, freight demand is expected to grow year-over-year starting in May, with dry van contract rates set to increase by 3.2% and dry van spot rates by 9%. This shift is anticipated to begin in Q2 2025, signaling a market turnaround. Despite the optimism, carriers are adjusting to changing conditions, with 49% planning to expand fleet sizes and services, while 43% intend to renegotiate contracts with existing customers to stay competitive.

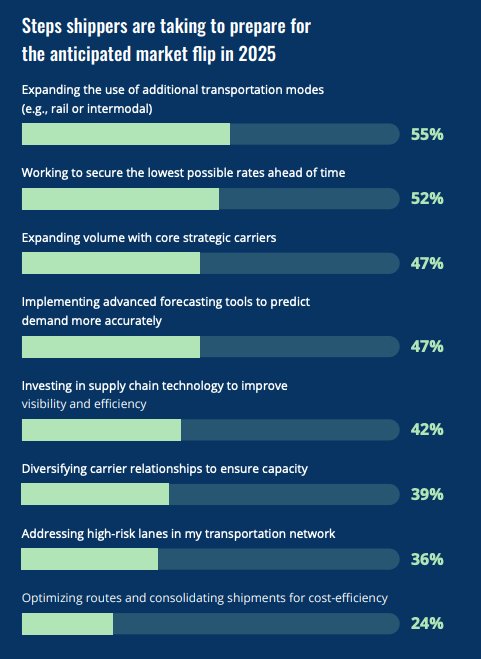

Shippers' Priorities

For shippers, cost remains the leading factor when selecting carriers. The report reveals that 57% of shippers prioritize cost above other factors, followed by on-time reliability (48%) and shipment schedules (37%). With economic uncertainty and rising rates, many shippers are turning to alternative transportation methods, such as rail and intermodal, with 55% of them considering an expansion of these options to optimize their networks.

Economic Pressures

The pressure of rising costs and shifting trade policies has slightly reduced the emphasis on sustainability in favor of managing immediate economic challenges. Shippers are also grappling with uncertainty around tariffs and regulatory changes, which is affecting their ability to meet sustainability goals without compromising their operations.

Key Takeaways:

- Freight Demand and Rate Growth: Freight demand is expected to grow by 1.4% in Q2 2025, with dry van rates increasing by 3.2% for contracts and 9% for spot rates.

- Shippers’ Cost Focus: 57% of shippers prioritize cost when selecting carriers, with many looking to alternative transportation modes like rail and intermodal (55%).

- Carrier Strategies: 49% of carriers are expanding fleet sizes or services, while 43% are renegotiating contracts to adapt to market changes.

- Supply Chain Challenges: 44% of respondents expect supply chain shortages, while 33% anticipate labor disruptions and regulatory changes.

- Sustainability Adjustments: Despite long-term sustainability goals, rising costs and trade uncertainties are leading shippers to adjust their focus toward economic resilience.

The freight market in 2025 will be shaped by a balance between demand growth, cost pressures, and evolving sustainability objectives, setting the stage for a more dynamic and challenging year ahead.

FREIGHT SNIPPETS ✂️

📝 English Language Proficiency | Following President Trump's March 1 executive order making English the official U.S. language, trucking industry leaders expressed concerns about enforcing English proficiency for drivers. James Lamb, president of the Small Business in Transportation Coalition, urged FMCSA to reinstate the policy of placing non-compliant drivers out of service. FMCSA guidelines require drivers to read and speak English for safety and regulatory compliance, but a 2016 policy change removed the out-of-service requirement for English proficiency violations. Read more.

🤝 EPA Reconsiders Requirements | The Trump administration has initiated the rollback of greenhouse gas emissions regulations for automobiles and trucks established under the Biden administration, the Environmental Protection Agency (EPA) announced on Wednesday. The agency will reassess emissions standards for light, medium, and heavy-duty vehicles starting with model year 2027. Read more.

🚨 Officers Seize $2.4M in Meth | U.S. Customs and Border Protection (CBP) officers at the Pharr International Bridge cargo facility seized $2.4 million worth of methamphetamine hidden in a shipment of Persian limes on March 7. The commercial tractor trailer, entering from Mexico, was selected for inspection by CBP officers. Using nonintrusive inspection equipment and a canine team, officers discovered 960 packages of methamphetamine weighing 268.96 pounds (122 kg) concealed within the shipment. Read more.

TOGETHER WITH TALENTO.

Talento is not just a nearshoring solution – it’s a partner in building and scaling a thriving logistics business. Focused entirely on freight, supply chain, and logistics, Talento offers more than just talent—it provides an entire ecosystem designed to support and optimize growth.

Beyond providing skilled, nearshore professionals, Talento helps diagnose operations, improve processes, and implement the right technology solutions.

Let Talento be the partner that helps build a dream team and scale smarter, faster, and limitess.

🌪️ Widespread Spring Storms | Severe storms, including tornadoes, dust storms, and wildfires, caused widespread destruction across the U.S., killing at least 32 people. Missouri had the most fatalities, with 12 deaths from twisters. Arkansas, Texas, and other states also suffered, with three killed in a dust storm crash in Amarillo, Texas. The storm impacted over 100 million people, bringing 80 mph winds and creating blizzard conditions in the north, while increasing wildfire risks in the south. Oklahoma saw over 130 fires, burning nearly 300 homes. Winds toppled trucks, and tornadoes continued on Saturday, especially in Louisiana, Mississippi, Alabama, and Florida. Read more.

🤝 Expanding Global Container Fleet | Triton International, the world’s largest container leasing company, will acquire Global Container International (GCI) in a deal expected to close in 2025. GCI, founded in 2018, manages 500,000 TEUs and serves top shipping lines. This acquisition will add GCI’s fleet to Triton’s 7 million TEU operation, boosting its market dominance. Read more.

🇨🇳 China Unhappy | Beijing has expressed dissatisfaction with CK Hutchison Holdings' decision to sell its majority stake in Panama ports to a consortium led by BlackRock, causing the Hong Kong-based company's shares to drop significantly. A commentary in the Chinese state-owned Hong Kong newspaper Ta Kung Pao criticized the sale, suggesting it would turn the Panama Canal into a political tool and limit China’s shipping and trade. The article, citing unnamed sources, labeled the deal as "profit-seeking" and accused CK Hutchison of "betraying" and "selling out" the interests of Chinese people. Read more.

NEW PODCAST 🎧

#77: Mia Mazal, Talento

Redefining nearshoring in the freight industry, Talento is focused on more than just labor—it’s about building an ecosystem of technology, partnerships, and smarter processes to help companies scale efficiently.

In this episode, Mia Mazal, co-founder of Talento, explains what happened with Sworkz and why she chose to launch her own company, how she’s addressing talent challenges in Latin America, and why a one-size-fits-all staffing solution doesn’t work in logistics.

🎧 Also available on Apple, Spotify, and wherever podcasts are available.

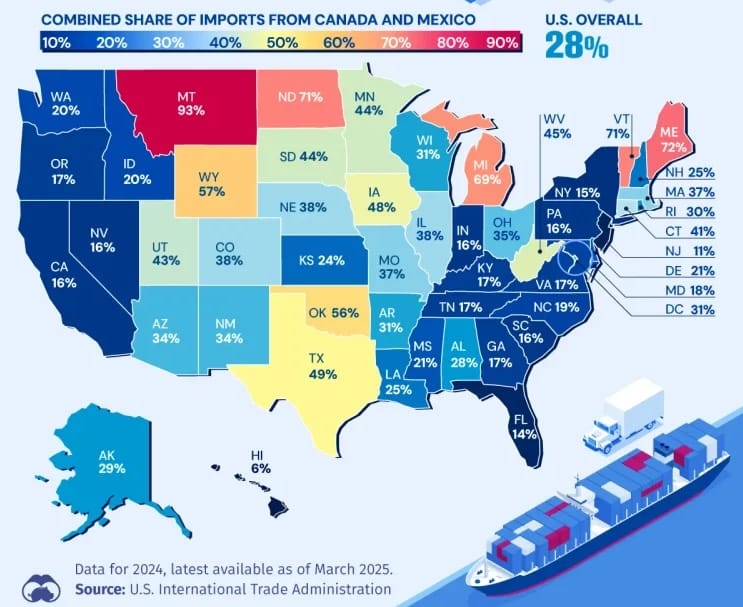

U.S. States That Import The Most 🇨🇦 🇲🇽

Using data from the U.S. International Trade Administration, we see the combined share of imports from Canada and Mexico for each U.S. state in 2023.

Montana leads with the highest import dependence at 93%, primarily due to its oil refinery operations importing crude oil from Canada. Other states with high dependence include Maine (71%), Vermont (70%), North Dakota (68%), and Michigan (69%). Michigan stands out as the only state where motor vehicles are the top import from both Canada and Mexico.

Overall, more than half of U.S. states rely on Canada and Mexico for 30% or more of their imports.

KAL Bankruptcy Liquidation 🏛️

Kal Freight will proceed with a Chapter 11 liquidation, confirmed by a U.S. Bankruptcy Court ruling, avoiding a Chapter 7 rapid closure. The company will sell its assets, including 1,500+ tractors and trailers, to Noor Leasing.

Creditors will fund the liquidation process, with asset transfer set for April 18. Despite concerns over stranded trucks, the process includes provisions to pay unsecured creditors via a liquidating trust. The company’s closure follows allegations of malfeasance but these aren’t directly addressed in the settlement.

MEME OF THE DAY! 😂