U.S Bank Freight Payment Index Shows Continued Trucking Contraction

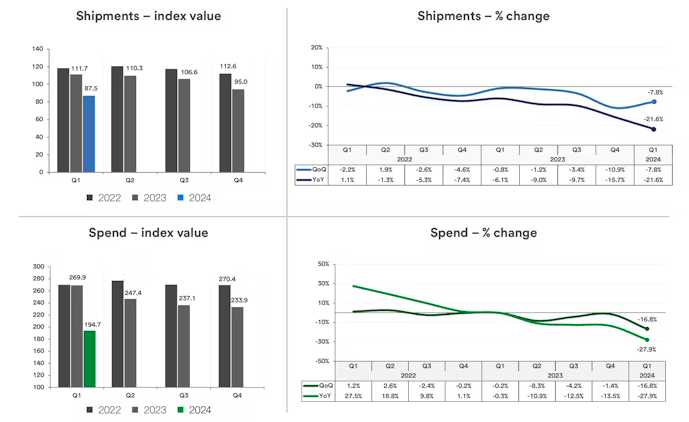

The U.S. Bank Freight Payment Index shows that truck freight lagged behind the overall economy in the first three months of 2024. This index, which mainly tracks contract rates, dropped significantly compared to both the previous quarter and the same period last year.

Several factors contributed to this decline, including harsh winter weather across the country. While February saw a slight rebound, the typical strong freight surge in March failed to materialize. This slump was further worsened by a decrease in shipper spending on trucking.

In comparison to Q1 2023, there was a 27.9% year-over-year decrease in freight spending, along with a 16.8% quarter-over-quarter decline. Shipment volumes also experienced a downturn, decreasing by 7.8% from Q4 2023 and by 21.6% year-over-year.

Across all regions except the Southwest, there were notable decreases in both shipments and spending. While the Southwest witnessed an 8.9% increase in volumes from Q4 2023, spending dropped by 16.5% during the same period. The Northeast bore the brunt of the impact, with spending and volumes plummeting by 34.8% and 33.9% year-over-year, respectively.

According to Chris Brady, analyst at Commercial Motor Vehicle Consulting (CMVC), the outlook for increased trucking capacity utilization won't improve until the latter half of the second quarter.